The Ill-Defined Space Spacecraft Market and Service Analysis, Pt. 2: 2024

Part 1 of this analysis covered the overall market and deployed spacecraft payload shares in 2024. This part (Part 2) goes into some detail about some of those market shares and deployments, specifically those from the United States, China, Russia, and France.

Again, Starlink dominates the charts. I will not post any charts that include Starlink in this analysis (because the charts become so meaningless) but will mention the numbers.

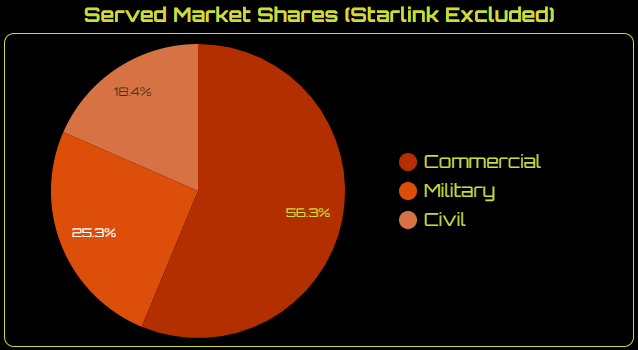

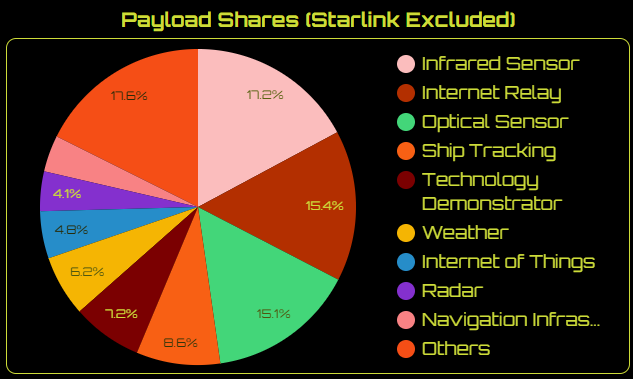

The space operators from all four nations deployed spacecraft that comprised about 94% of all deployments in 2024. Nearly 90% of the spacecraft deployed by those nations' space operators were for serving the commercial market. Spacecraft deployed for military missions had about a 6% share. Spacecraft with payloads catering to civil missions took a little over 4%. Over 81% of the spacecraft deployed from the four nations had communications payloads, specifically for internet relay, ship tracking, and cellular communications. Satellites with remote sensing payloads (infrared (maybe), optical, weather, and radar) took ~11%.

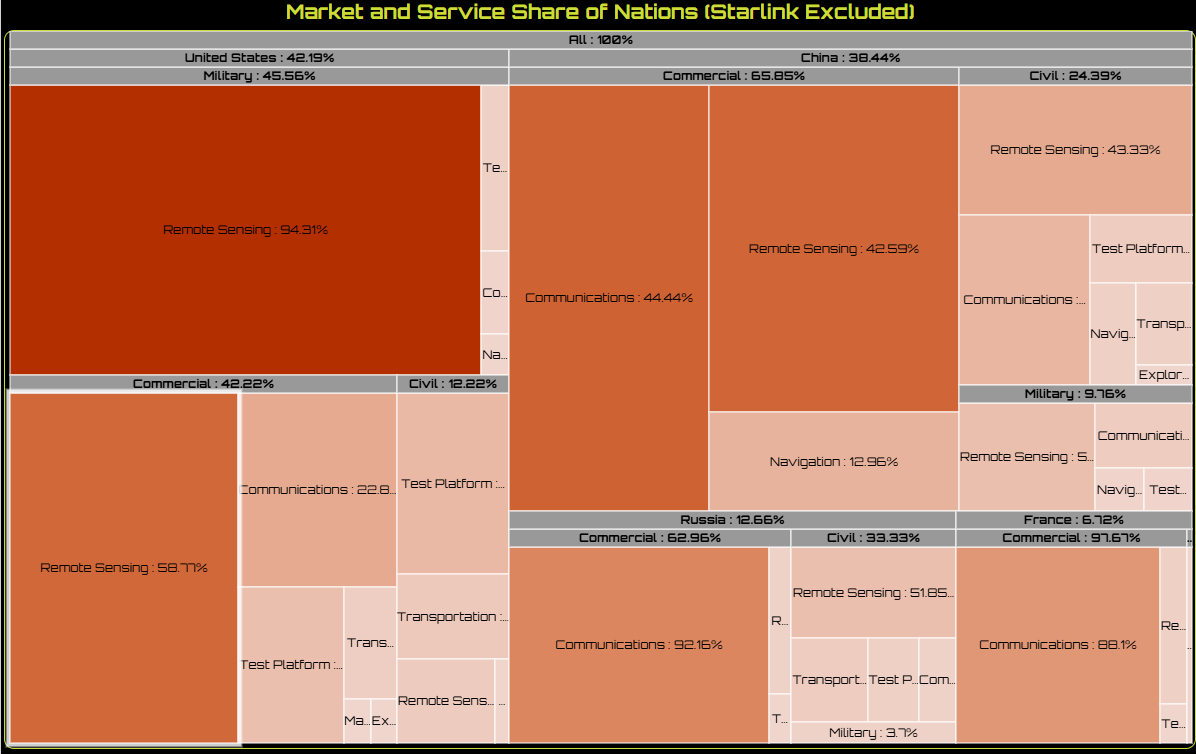

As noted in Part 1, excluding Starlink pares down the world’s spacecraft deployments to ~819. The share of the world’s 2024 spacecraft deployments for the United States, China, Russia, and France was nearly 81%. The treemap below shows that U.S. space operators deployed more spacecraft in 2024 than any of the other three, over 42% of an estimated 660+. Spacecraft operators from China accounted for nearly 30.5% of spacecraft deployments, Russia’s took about 13%, and France’s operators accounted for almost 7%.

Based on much media coverage, some people could be forgiven for anticipating that the U.S. space operators were deploying most of their spacecraft for commercial markets (excluding Starlink). I did not expect the switch in the markets that China’s and the U.S. space operators served. If Starlink had been included, the share switch wouldn’t have occurred. U.S. deployments for the commercial market (at least one particular market) would have had a dominant share of all U.S. spacecraft.

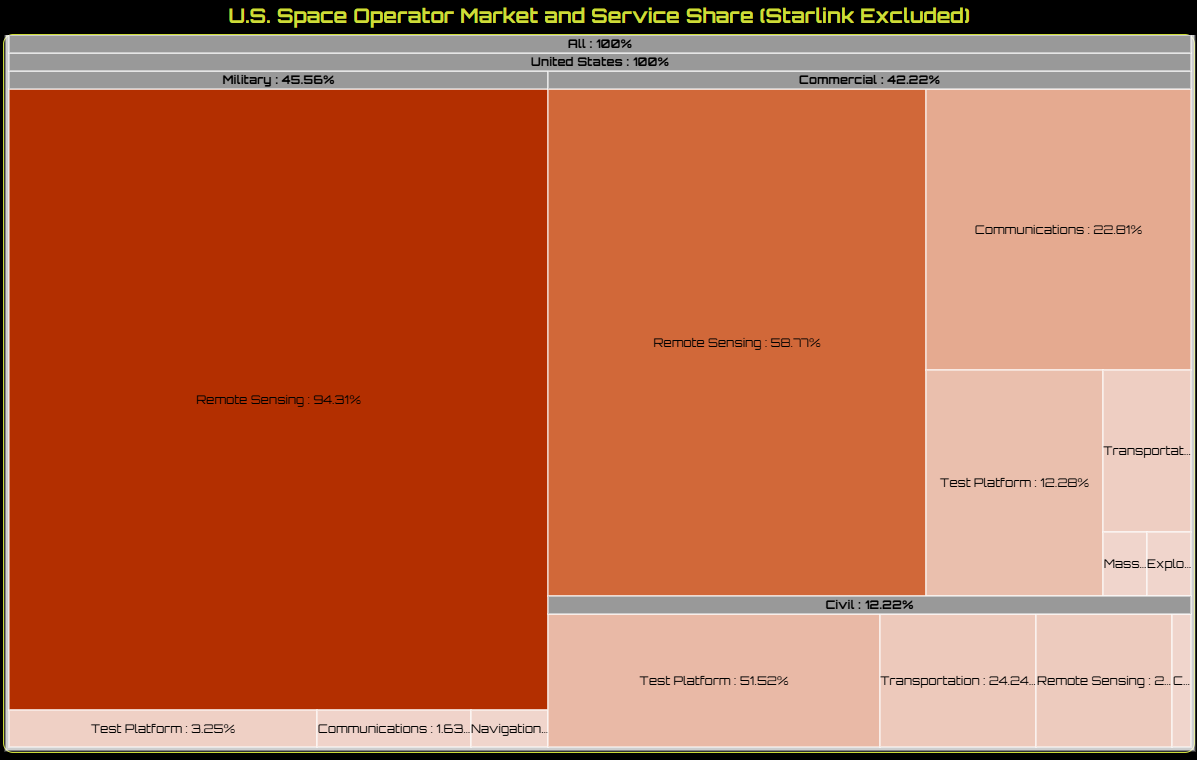

However, excluding Starlink, nearly 46% (the majority) of U.S. spacecraft deployed in 2024 were for military missions. The National Reconnaissance Office (NRO) deployed the most U.S. military satellites. Spacecraft deployments for commercial markets came in a close second, but it was still a little surprising to see military deployments with a majority share. As mentioned in Part 1, the type of payload on the NRO’s satellites might be wrong. The payload could just as well be radar, hyper-, or multispectral–any payload that fits with the NRO’s reconnaissance mission.

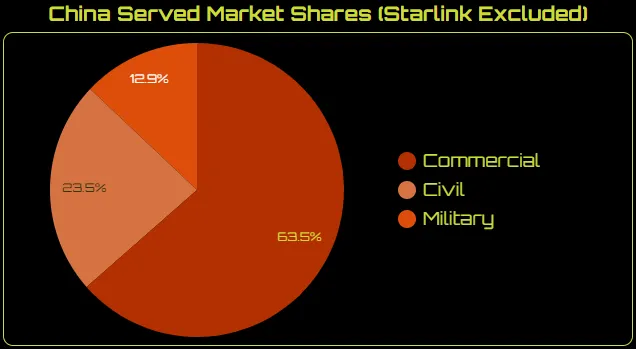

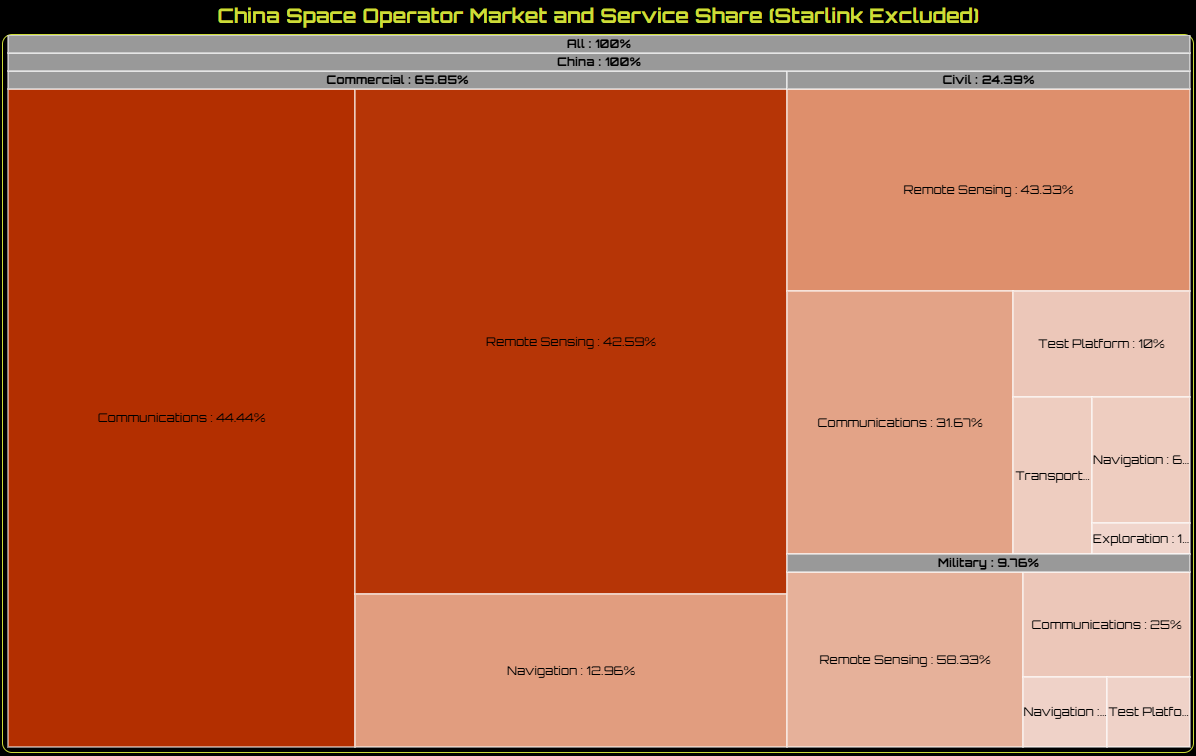

Again, based on media coverage and commentary (especially from U.S. military leadership), China’s spacecraft operators were suspected of deploying primarily military spacecraft. However, nearly 66% of China’s spacecraft were deployed for commercial services, followed by a little over 24% for civil missions (such as weather satellites). Although, an argument could be made over whether Genesat is a commercial service provider. Spacecraft deployments for China’s military missions barely reached 10% in 2024.

Because all four nations make up over 80% of spacecraft deployments, there’s little deviation in their shares of commercial markets from the rest of the world’s spacecraft deployments in 2024. However, the military share of the U.S. spacecraft deployments significantly increased, allowing the share of spacecraft deployments for military markets to move to second position with a little over 25% (it was 22% overall) and causing civil deployments to sink to third with 18% (civil missions took a 24% share overall). As noted, that military share increase was mainly due to the NRO’s spacecraft deployments.

The four nations’ space operators’ shares and types of payloads on satellites deployed in 2024 didn’t deviate much from the global shares, except for ship tracking and weather. Nearly 51% of spacecraft deployed from those nations had payloads providing remote sensing services (infrared, optical, radar, weather, etc.). Over 33% provided communications services (internet relay, IoT, ship tracking, etc.), and almost 8% were for technology demonstration and testing. Payloads providing navigation services took about 4.5% (GPS, GeeSat, etc.).

United States Specifics

Over 50 U.S. space operators deployed spacecraft in 2024. While the NRO deployed the most satellites, commercial companies such as Planet and HawkEye 360 also deployed plenty. NASA deployed the third-highest number of U.S. spacecraft in 2024.

U.S. military space operators deployed most of the U.S. spacecraft in 2024, over 46%. However, commercial space operators came in a close second with nearly 42%. Civil missions only took a little over 12%. The shares are slightly off from the treemap above because while I might know a mission is for the U.S. military, sometimes I’ll have no clue what type of mission or payload it might be. So, I count the satellites as military without adding payload information.

Excluding Starlink, the U.S. military market share is so large primarily because of the NRO’s (presumably) remote-sensing spacecraft deployments during 2024. While the total for the NRO’s constellation is unknown to the public, using Planet as a template for remote sensing deployments (somewhere around 200-250 satellites), the NRO will probably deploy about 100 more in 2025. The SDA is also supposed to deploy satellites for its tranches this year. Both agencies’ activities mean that the U.S. military will deploy more satellites and that its share will probably grow in 2025.

Satellites with remote sensing payloads also comprise the majority of the U.S. commercial market. Companies such as Planet use satellites with optical sensors to provide imagery. In contrast, HawkEye 360’s satellites are equipped with radio-frequency monitoring payloads that search for and detect faint radio signals from the Earth. Communications had the second-highest share of U.S. commercial satellites deployed in 2024, primarily with ship tracking (Spire) and cellular (AST SpaceMobile) payloads.

Most U.S. civil spacecraft were operated by NASA (or by SpaceX for NASA). Because NASA is known for research and development, it should be unsurprising that over 51% of its spacecraft deployed during 2024 had test payloads.

China Specifics

At least 39 operators from China deployed spacecraft. The commercial company Genesat, an internet relay service provider, deployed the most in 2024. However, the People’s Liberation Army deployed many spacecraft as well. Other commercial companies, such as GeeSpace and Tianjin Yunyao Aerospace Company, contributed significantly to China’s commercial market gains in spacecraft deployments.

Space operators in China serving the commercial market increased their deployments in 2024, deploying nearly two-thirds of spacecraft from that nation. Spacecraft for China’s civil market took up almost a quarter of spacecraft deployments, while only 13% were for China’s military market.

Most of China’s commercial operators' 2024 deployments were for communications satellites, with Genesat’s G60 constellation accounting for the majority (78%). The company plans to deploy about 12,000 satellites. Guodian Gaoke’s Internet of Things satellite deployments had a ~17% share.

Satellites deployed by companies such as Tianjin Yunyao Aerospace Company and Guang Chang Satellite Technology Co. Ltd. gained a large share of commercial remote sensing. Of all space-provided services, commercial remote sensing services had the largest number of commercial companies from China, about 17. Only one company, Geely, deployed satellites with navigation capability (although the company’s GeeSpace satellites also provide communications).

In 2024, civil spacecraft from China accounted for about 25% of all spacecraft deployments. Most civil-operated spacecraft had a remote-sensing payload, the majority of which was optical. However, a few spacecraft also had radar payloads. China’s civil organizations were among the few that deployed cargo and passenger transportation to orbiting space stations.

The majority of China’s military spacecraft appeared to have remote-sensing payloads.

Russia Specifics

About 18 Russian operators deployed spacecraft in 2024. The number of operators is tiny compared to those from China and the United States. Perhaps surprisingly, the number of spacecraft deployed for commercial markets had the largest share of spacecraft deployed by Russian organizations–60%. One reason for that share will be explained later on. However, a fact to keep in mind while thinking about Russian spacecraft deployments is that they are low in number.

Russian space operators deployed fewer than 90 spacecraft in 2024. A company deploying over 40 satellites would appear dominant in the nation, with perhaps more than half of all Russia’s spacecraft deployments. The overall low number of spacecraft encourages that perception.

Spacecraft deployed for Russian civil missions in 2024 made up about 32%, while spacecraft deployed for military missions had slightly over 8%.

Focusing on Russian spacecraft deployed for commercial markets, the great majority were for communications. 100% of the satellites deployed for communications were for Sitronics. The company’s satellites have an estimated 4.5-kilogram mass and a ship-tracking communications payload. So, while Sitronics deployed many spacecraft during 2024, the total mass of its spacecraft was barely over 202 kg.

Over half of the spacecraft Russia’s civil space operators deployed had remote sensing payloads. The majority of those were smallsats hosting payloads that provided for space observation and Earth sciences. The most important civil missions were likely those traveling to the International Space Station with cargo and passengers. While it’s a guess, it’s probable that all of Russia’s military satellites deployed during 2024 were for remote sensing.

France Specifics

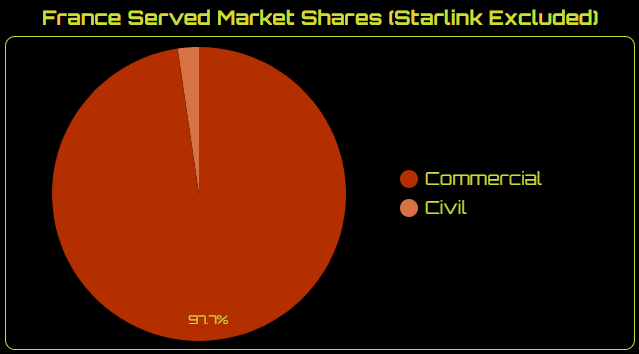

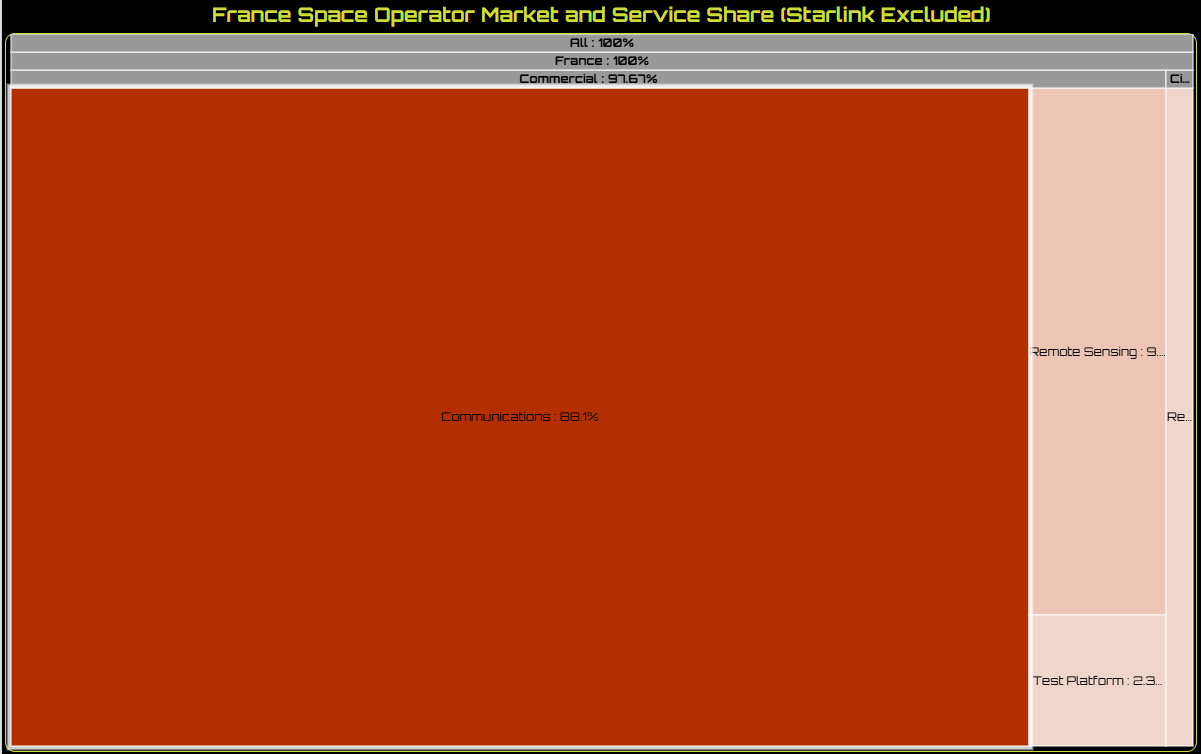

Seven French spacecraft operators deployed satellites in 2024. Nearly 98% of the satellites deployed were for commercial services, and the remainder were for civil missions.

Over 85% of commercial satellites deployed by French operators during 2024 were for providing communications services. The majority of commercial communications satellites had internet relay payloads operated by Eutelsat/OneWeb. However, slightly over 40% were Kinéis-operated satellites with Internet of Things payloads. All of France’s commercial satellites deployed to service the remote-sensing market in 2024 had radio frequency monitoring payloads operated by Unseenlabs.

The single satellite deployed for a civil mission had a remote-sensing payload operated by a French university.

Those are some of the details of the four nations with space operators that deployed more spacecraft in 2024 than other nations. Again, Starlink deployments were excluded, but even excluding those satellites, many spacecraft were deployed in 2024. One expects that a nation with a reliable orbital launch capability can deploy a lot of satellites. The data bears that expectation out for China and the United States. Russia’s lower numbers shouldn’t be surprising, however, as they result from the consequences of its Ukraine invasion.

Again, this is just for 2024. There’s more information behind these trends than just the numbers. If you’re interested in a consultation, please contact me through LinkedIn.

If you liked this analysis (or any others from Ill-Defined Space), please share it. I also appreciate any donations (I like taking my family out every now and then). For the subscribers who have donated—THANK YOU from me and my family!!

Either or neither, please feel free to share this post!

Comments ()