Starship’s Impacts on Smallsat Launch? Or is it Something Else?

Based on a sampling of last week’s articles, the most triumphant aspect of Starship’s third launch test was its marketing. The coverage of Satellite 2024 in Washington, DC, demonstrated the latest Starship launch as top-of-mind. Some of the show’s panels, particularly those focused on the launch industry, couldn’t help but bring up Starship, even though it still has not deployed spacecraft to orbit. Moderators mentioned it. Panelists were concerned about it. And reporters reported it.

For example, in the session about the small satellite ecosystem, some of the panelists expressed concern about Starship's impacts on small satellite launch providers. In short, the concerns are nothing new:

- Small satellite operators will pay less money deploying with Starship

- Space tug offerings will help smallsat operators transition to Starship

- The rush of small satellite operators to use Starship will result in a SpaceX monopoly of the smallsat launch sector

- Starship will encourage smallsat operators to build larger satellites

None of those concerns are new because SpaceX and its Falcon 9 have already validated them (except maybe the last bullet). People already pay less money for Falcon 9 rideshares. They are using space tugs to get to their desired orbits. There have been quite a few smallsat operators that have taken advantage of both. Starship would be a continuance of those trends.

Admit Having a Problem

The fact that these panelists are rehashing these challenges shows the determination of the companies they represent to continue pointing fingers externally. They’d rather do that instead of implementing plans to compete against trends that have been ongoing for some time. A company with a healthy competitive outlook might view those concerns as innovation sources to build a more robust business plan for success.

Some subscribers might recognize some of these words because I mentioned them in October 2023’s “The Weirdest Delusion.” The similarity is because the concerns mentioned at Satshow are the same ones mentioned at last year’s Satellite Innovation conference. In “The Weirdest Delusion,” the complaints were about the low pricing of SpaceX’s Smallsat Rideshare program, which uses its Falcon 9.

The panelists’ responses to those concerns are, ah, concerning. Arianespace, for example, continues to say it’s just unwilling to compete with the Falcon 9’s rideshare business. Isar Aerospace’s representative promoted a “sticking one’s head in the sand” approach. Her quote in the SpaceNews article made it quite clear:

“Playing catchup and trying to figure out how SpaceX is doing things or not doing things, without knowing what the future will be, is irrelevant.”

Maybe the reporting misquoted her, but understanding what the competition is up to (which includes figuring out SpaceX’s activities) is a fundamental business practice. These companies have already admitted that SpaceX is shaping their market segment with its offerings. Ignoring how the company is achieving that impact is plain unwise. To believe a company needs to know the market’s future also displays a misunderstanding of competing generally. But then Isar’s panelist doubled down on that sentiment by saying:

“What we need to do is to encourage and stimulate the market as a system to have the capacity and demand for what we are providing.”

That statement matches the innovation source mentioned in “The Weirdest Delusion,” which contradicts what the market tells these companies and what these companies choose to believe. The incongruity is that these smallsat launch companies…

“...seem to believe that offering limited launch capability for a high cost per kilogram is valuable to customers. They seem to think that customers should be attracted to their high-priced service, even if smallsat-dedicated rockets don’t launch as often, can’t carry as much, might explode occasionally, or not even exist. Smallsat launch service launch costs are high even when compared to an Ariane 5 or Delta IV launch.”

The Isar representative seems to think that these smallsat companies need to make the market customers bear all of these smallsat launch drawbacks: higher prices, infrequent and unreliable launches, and ghost smallsat rockets. The smallsat launch startups must contend with these challenges from the get-go, and the failed startups have demonstrated an inability to do so.

None of the drawbacks involve SpaceX and its rideshare missions. However, the company’s Smallsat Rideshare program limits startups’ latitude for making mistakes. If it is successful, Starship will narrow that even more while impacting companies with larger rockets. But Starship’s existence doesn’t mean a launch startup can’t succeed.

It Began Before SpaceX

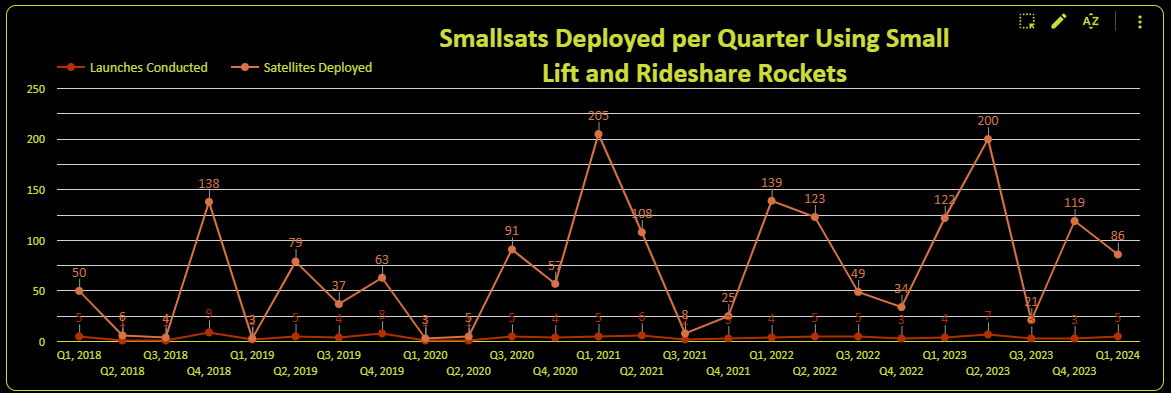

Their focus on SpaceX, however, also demonstrates their lack of knowledge of their other competitors (encompassed in the chart below).

The chart shows the rockets (101 launches) used to deploy smallsats (nearly 2,000 of them), not just the smallsat-focused (1,500 kg or less) ones but those launching rideshare missions as well. I define smallsats as satellites with a mass of 600 kg or less. Rideshare rockets are rockets that launch spacecraft with three or more different customers operating the satellites (so, in most cases, at least three other satellites).

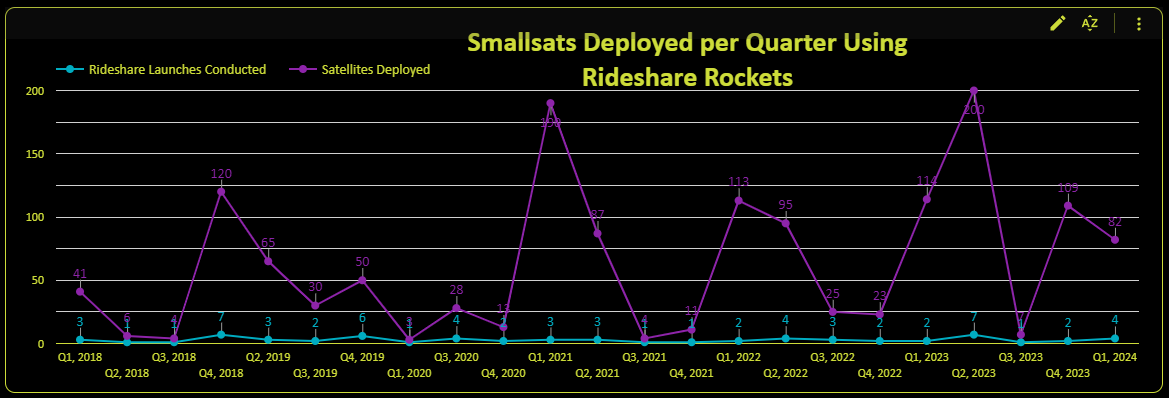

The rockets launched have funny-sounding names, such as PSLV, Soyuz, Kuaizhou, Jielong, Long March, and more. There are also a few SpaceX Transporter missions in the mix, but other organizations offered rideshare missions long before SpaceX (and they still provide them). The following chart shows that rideshare launches have always deployed the most smallsats compared to smallsat launchers. It’s just that SpaceX made it cheaper and more convenient.

Rideshare launches occurred before January 2021. SpaceX’s contribution is obvious in that more spacecraft were deployed (the bigger bumps) afterward. However, some rideshares after January 2021 were also conducted by PSLV and Soyuz rockets.

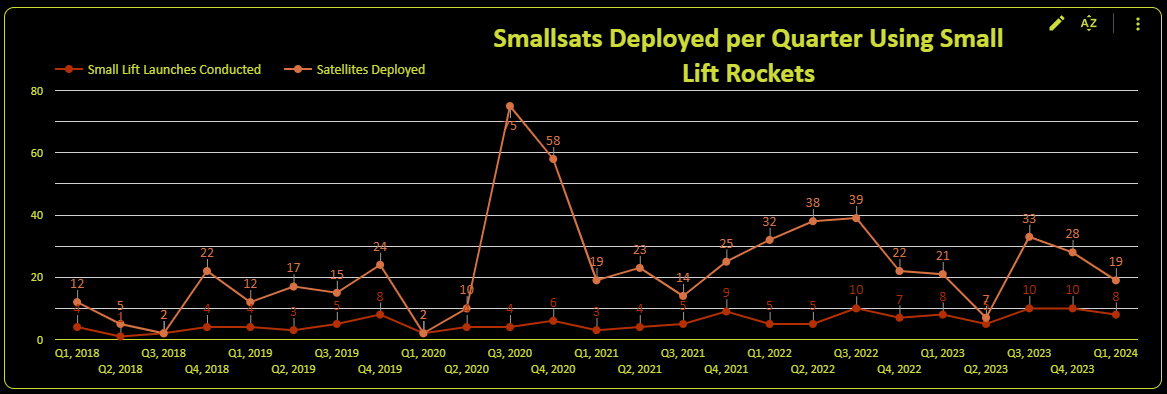

Here’s the chart showing all the small satellite deployments and the smallsat (small lift) launches that deployed them.

For those attempting to add the last two charts, don’t. The previous chart contains a few small lift launchers used for rideshare missions.

Smallsat launches rise slowly, even as SpaceX and others continue launching rideshare missions. That trend might be good news for those seeking to enter the small lift market. That observation should be tempered by the fact that the number of launches, while growing, is still modest, with none exceeding ten per quarter. That is another reason that customers have turned to rideshare services.

However, the average number of satellites each smallsat launcher has deployed seems to be decreasing (although it’s above its Q1 2018 start). Comparing the last two charts, the disparity between rideshares and small lift are evident in Q2 2023. Five smallsat launchers deployed seven smallsats in that quarter, but the seven rideshare launches deployed 200.

The charts indicate that most circumstances fostering the panelists’ concerns with Starship (and Falcon 9 rideshare) have existed for years. Rideshare has always competed for their business (Dnepr Cluster missions, anyone?), and there’s no reason to think that option will fade away.

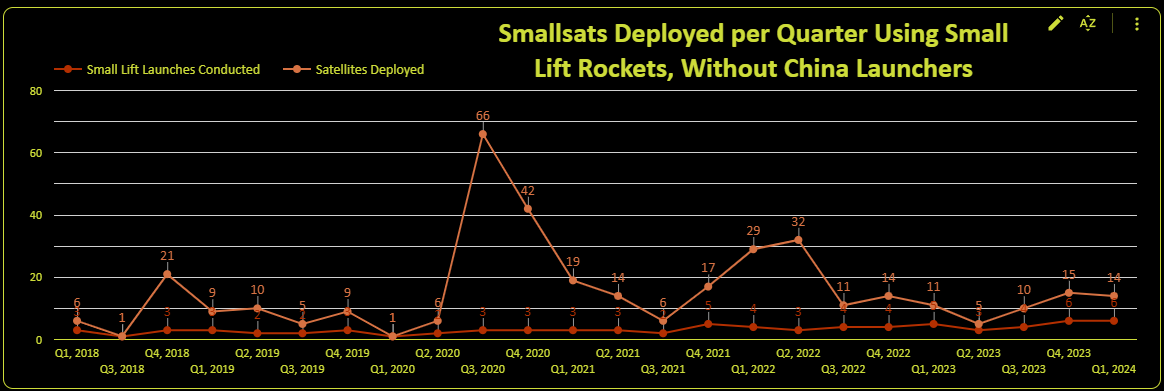

There also seems to be no mention of smallsat launch options in China (also, why no panelists from China?). If launch operators from that nation open up, their presence would be more devastating than SpaceX on other smallsat operators. Even though they don’t yet compete for smallsat launch operators that earnestly, China’s smallsat launch operators conduct a significant share of launches.

As the chart above shows, removing China’s share of small lift launches shows the other smallsat launch operators with less than half of those launches. It shows a corresponding decline in smallsat deployments, too. Keep in mind that some of those launches were conducted by small lift vehicles that are no longer, such as Astra and LauncherOne.

Real Problems

There are also smallsat launch startups, within which are a stream of companies that have designed smallsat rockets but never developed them. Some of the existing smallsat rockets have reliability challenges. All are expensive, even before SpaceX’s rideshare pricing, and almost all share the trait of yet proving that dedicated small satellite launch is worth pursuing.

But ignoring the competition and hoping the market somehow will embrace the weaknesses and unrealistic expectations of smallsat launch companies is unrealistic. Only one company can get away with telling its customers that a product isn’t working because of customers’ expectations: Apple. And yet, some of the panelists are attempting to tell potential customers exactly that.

Small satellite operators are typically the most financially vulnerable companies. They want to spend less on launch and obtain a reliable launch vehicle. It would be irresponsible if they didn’t choose the least expensive but most reliable launch option. Hoping that the market will change to make an unacceptable proposition more acceptable to these smallsat operators is not just delusional; it is customer-hostile.

Another form of delusion is to believe that the price SpaceX charges for its rideshare offering is unrealistic, even as SpaceX upped the pricing. Clearly, Starship, if it becomes operational, will impact their businesses. However, some of these companies already seem to be struggling to understand and compete with the current competition.

If you liked this article (or any others from Ill-Defined Space), any donations are appreciated. For the subscribers who have donated—THANK YOU!!

Comments ()