Picking a Proven Winner: NRO and Starshield

My analysis showed how much of the Space Development Agency’s (SDA) struggles are shaped by the DoD’s history. That the agency is building a satellite manufacturing base and supply chain that the DoD never required before. The SDA’s awareness of the fragility of that burgeoning supply chain and that the success of its acquisitions plan depends on consolidated legacy businesses such as Lockheed Martin and Northrop Grumman.

That none of the legacy businesses have experience building as many satellites as the SDA requires (1,000) in a short time (by 2026). I also hinted that the deployment of DoD satellites in the past few years has increased, but no thanks to those companies.

This is a continuation of the initial analysis, which explores more of the SDA’s challenges, starting with the current state of spacecraft deployments. Remember, from 2018 through 2021, the U.S. military deployed an average of 21 satellites yearly. Significantly more DoD-operated satellites were deployed from 2022 through 15 December 2024. The DoD deployed an average of ~65 satellites per year during that period, totaling almost 200 satellites.

Enter Starshield

The problem for SDA and its small satellite manufacturing contractors is that only about 35 (18%) of those deployments were for the SDA (including a few demonstration and joint satellites). Its deployments result in a higher average than the DoD’s overall satellite deployments from 2013 through 2017 (8) but is a smaller than expected share of military satellite deployments for 2022 through 15 December 2024. The SDA deployed the second-highest share of U.S. military satellites during that period.

The National Reconnaissance Office (NRO) deployed the most.

During that same time, the NRO deployed an estimated 142 satellites, most of which use SpaceX’s Starshield satellite bus (~116). The NRO’s deployments mean that 60% of DoD satellites deployed from 2022 through 15 December 2024 use SpaceX’s satellite manufacturing capability. Sixty percent of the U.S. space capability in 2024 relied on SpaceX.

SpaceX’s share of DoD satellite deployments is smaller than its global spacecraft deployment share, approaching 71% for the same period. However, it should be alarming (but not surprising) that the DoD is allotting a large share of its defense satellite manufacturing to SpaceX. And that it’s done so in three years. It went from one extreme–disseminated, if expensive, contract awards among several satellite manufacturers to another, where almost ⅔ of its deployed satellites come from one company.

To be fair, the details of the NRO’s Starshield deal with SpaceX are vague. Reporters have dug up a $1.8 billion contract the NRO awarded to SpaceX for Starshield–in 2021. At a guess, the latest versions of satellites are based on Starlink’s ~740-kg satellite bus. They also appear to host more than the usual Starlink communications suite. According to the NRO, the satellites can:

“...track targets on the ground and share that data with U.S. intelligence and military officials…”

That capability is in line with the NRO’s mission, which is:

NRO develops and operates the world’s most capable and innovative overhead reconnaissance systems to collect intelligence for U.S. national security, and to support disaster relief and humanitarian efforts.

Starshield Guesses

Based on more guesswork, the satellite description and the NRO’s mission suggest that its Starshield satellites are for intelligence collection, such as imagery, radar, or infrared. Their deployment formation makes it unlikely that they are signals intelligence collection satellites, such as those in LEO operated by HawkEye 360 or the People’s Liberation Army. I also have some doubts about the fact that the Starshield-based satellites are optical, although Planet managed to demonstrate how its optical satellites could “track” a rocket launch in 2017.

However, the fact that there are so many commercial optical smallsat companies with data the NRO could buy might mean that the acquisitions agency would allocate its budget to other sensors. For example, an SDA demonstration satellite using a Starlink bus had a Wide Field of View (WFOV) infrared sensor payload, which may hint at the NRO’s sensor payload. And since Planet’s optical tracking of a launch occurred over seven years ago, maybe the NRO bought the patent to do the same with its infrared or radar sensing payloads.

To make things more complicated (and capable), it may be that the Starshield-based satellites still retain Starlink communications capabilities, including crosslinks. SpaceX typically deploys fewer NRO Starshield satellites per launch than its Starlinks. The lower number may be due to the additional mass of payloads added to the Starshield bus.

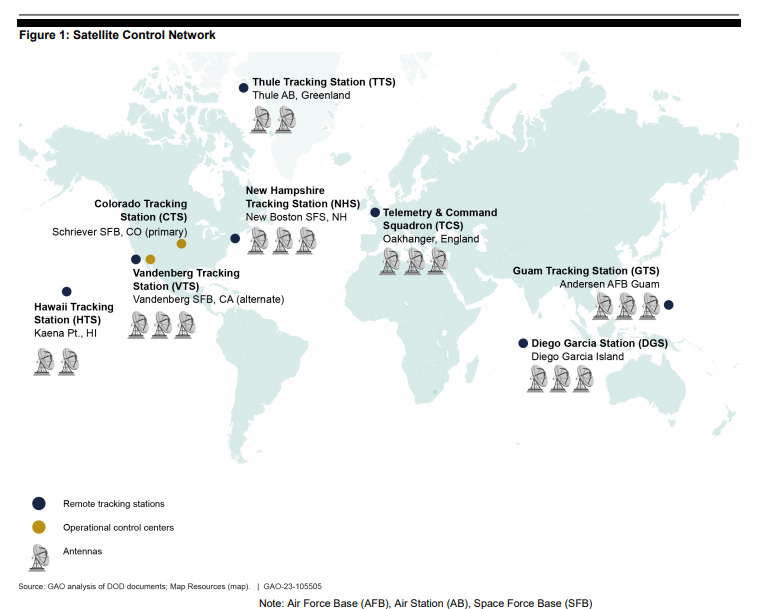

Image from the Government Accountability Office, page 3: https://www.gao.gov/assets/D23105505.pdf

Because of the possible Starlink capability, the size of the NRO’s constellation, and the speed of its implementation, it’s doubtful that Starshield commanding and telemetry communications use traditional DoD-owned ground systems, such as the Space Force’s Satellite Control Network (map above). To me, that means the NRO is probably using Starlink-based ground architecture since the SCN–its bandwidth, a small number of remote terminals, and sharing with other users–wouldn’t be up to the task of relaying data, perhaps in real-time, for tracking targets on the ground (and sharing it). Plus, it fits in with SpaceX’s proprietary Starlink system.

Mission-Oriented Program?

By May 2024, the company conducted the first mass deployment of its NRO Starshield satellites. That means most of the NRO’s Starshield-based satellites were deployed in the last eight months (including December). The organization suddenly went from operating tens of satellites to over one hundred in less than a year. How many NRO satellites will be deployed using SpaceX’s Starshield is still unclear. But the fact of the matter is that the NRO’s fleet of Starshield-based satellites is almost four times the SDA’s Tranche 0 constellation so far.

I’ve already explored a few reasons why Starshield should concern the legacy satellite manufacturers in “The End of the Beginning of the End (of Expensive Satellites).” The NRO doesn’t appear to require various steps, such as the SDA’s tranches, for its satellites, saving time. It’s dealing with one prime contractor, saving time that way, too. It also adopted SpaceX’s Starlink bus quickly. Perhaps the NRO saw validation of SpaceX’s satellite bus because it had more satellites in orbit than any other organization by the time the contract was signed.

The first mass deployment of any Starlink satellites occurred in 2019, with the NRO contract awarded less than two years later. SpaceX was on its third Starlink iteration by the time of that award and had deployed nearly 2,000 Starlink satellites. No other satellite manufacturer came close (they still don’t). The NRO appears content with the latest iteration of Starshield-based satellites deployed thus far (although, would anyone outside the NRO and SpaceX hear about dissatisfaction?).

The NRO is doing the opposite of the SDA. It’s not trying to build a satellite manufacturing ecosystem. Instead, it chose to work with the company that succeeded in deploying thousands of low Earth orbiting internet relay satellites. SpaceX proved it had the satellite manufacturing scale and a supply chain to keep up with its manufacturing pace (although, it’s a wonder how a U.S. specialized infrared or radar parts manufacturer can keep up). None of the SDA’s other contractors can claim anything similar. They should also be thankful that SpaceX isn’t offering its bus commercially yet.

Because of this choice, the NRO’s satellites outnumber the SDA’s significantly. It’s well on its way to (if not already) fulfilling its mission, whereas the SDA is still worried about the supply chains of its satellite manufacturers. This is not to say that the NRO is correct in its selection (only it can determine that) or that the SDA is wrong. Having a robust satellite manufacturing market is a great thing to have.

But if it’s developed only to serve the U.S. military, is that healthy or diverse enough for those companies? It seems like it would increase their dependence on U.S. government contracts. On the other hand, it’s certainly laudable that the NRO can quickly gain abilities with Starshield, but is fostering an increased dependence on SpaceX a good idea?

If you liked this analysis (or any others from Ill-Defined Space), please share it. I also appreciate any donations (I like taking my family out every now and then). For the subscribers who have donated—THANK YOU from me and my family!!

Either or neither, please feel free to share this post!

Comments ()