More Upmass!! (Or, Small Launch=Little Business)

This analyzes an aspect of orbital rocket launches in 2024, specifically, the upmass rocket categories launched from each nation. It begins with a chart I used in the 2024 launch summary. For the readers looking for a report on the overall launches, I recommend reading the summary.

Stating the Obvious

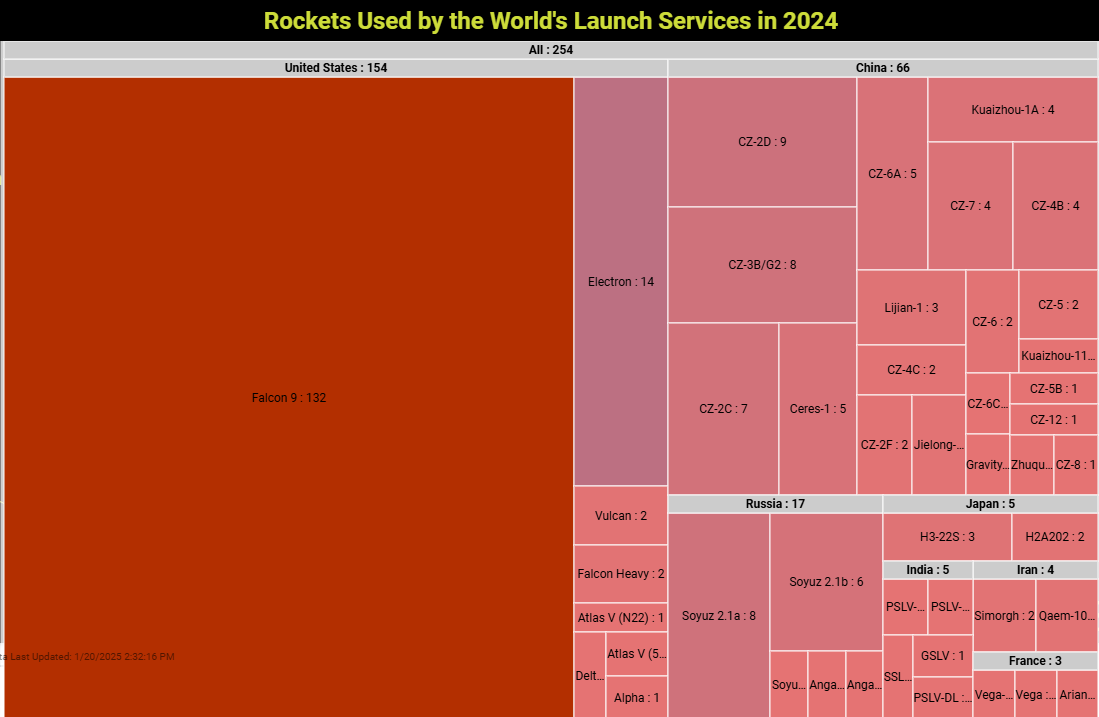

The treemap above, a visual representation of successful orbital launches conducted in 2024, makes a few things quite obvious. For one, SpaceX launched more orbital rockets (Falcon 9 and Heavy) than all the other launch providers and nations combined.

China’s diverse rocket inventory is also made evident in the treemap. The nation launched more rocket families (16) in 2024 than the sum of those used by the U.S., Russia, Japan, India, and Iran. Russia still relies on a rocket, the oldest launch system of the world’s rockets, the Soyuz. I believe Sergei Korolev would have expected more progress from Russian space prowess at this point.

And for Japan, it’s a little unexpected to see the Japan Aerospace Exploration Agency (JAXA) use its newest rocket, the H3, not just once in 2024 but three times, with its first launch of the year being the rocket’s first successful launch (its 2023 inaugural launch failed). ULA and Arianespace could learn a thing or two from that new system’s launch cadence. Or perhaps JAXA is taking an unusually aggressive and risky pace.

ULA’s launches are down to five, two of which used its new Vulcan rocket, while Arianespace merely launched three (one of which was the new Ariane 6) for the whole of 2024.

Not obvious, but generally known, Falcon 9 and Heavy were the only rockets with some form of reusability launched in 2024. Also, the treemap hints that without SpaceX, launches from the remaining U.S. launch services would have placed the U.S. launch totals in second position at 20 orbital launches. Adding back the non-Starlink SpaceX launches places the total number of successful U.S. orbital launches slightly ahead of China’s 68.

Either way, many customers depended on SpaceX to get satellites into orbit. Without SpaceX, they would have been forced to wait and pay more for the privilege of waiting and launching with someone else, which isn't ideal for some space operations startups.

Upmass Categories

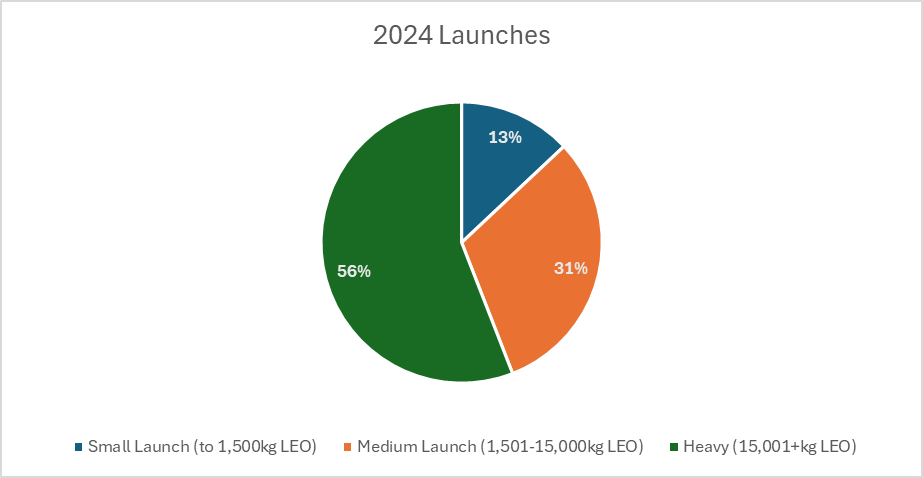

I use three categories for rocket upmass capability: small, medium, and heavy. Small includes rockets capable of lifting up to 1,500 kg to low Earth orbit. Medium covers those rockets able to lift 1,501-15,000 kg to LEO, and heavy covers the rest (15,001+ kg to LEO). Based on the results, I might have to recalibrate, but my current categorization shows an unexpected data point: heavy-class launchers were the most used launchers in 2024.

Heavy-class rockets include the Falcon 9, Falcon Heavy, Vulcan, Angara A5, CZ-5, etc. Medium-class rockets include Soyuz, PSLV, GSLV, H3, CZ-12, Jielong-3, etc. Small-class rockets include the Electron, Alpha, SSLV, Simorgh, Kuaizhou-1A, Ceres-1, and more.

56% of 254 successful orbital launches conducted in 2024 used heavy upmass-capable rockets that lift 15,001 or more kilograms. 31% were medium-capable, while small upmass-capable rockets (essentially smallsat-focused rockets) made up the remaining 13%.

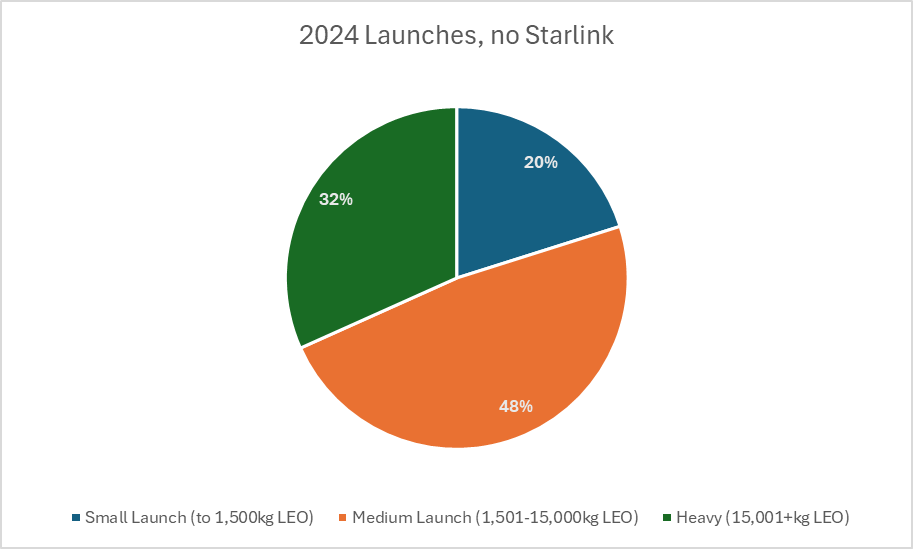

Of course, there were many heavy-capable launches in 2024 because there were many Starlink launches (~90). Subtracting those 90 Starlink-dedicated launches shows a more realistic (?) launch market, with medium-capable launchers accounting for nearly half of all launches in 2024.

Small-Class

Small launchers still took the least share of launches, 20%, which is remarkable considering that an inordinate number of space startups advertise their focus on developing small satellite launch systems (as they’ve done for over a decade). But then, many of those startups don't consider the reality of the market.

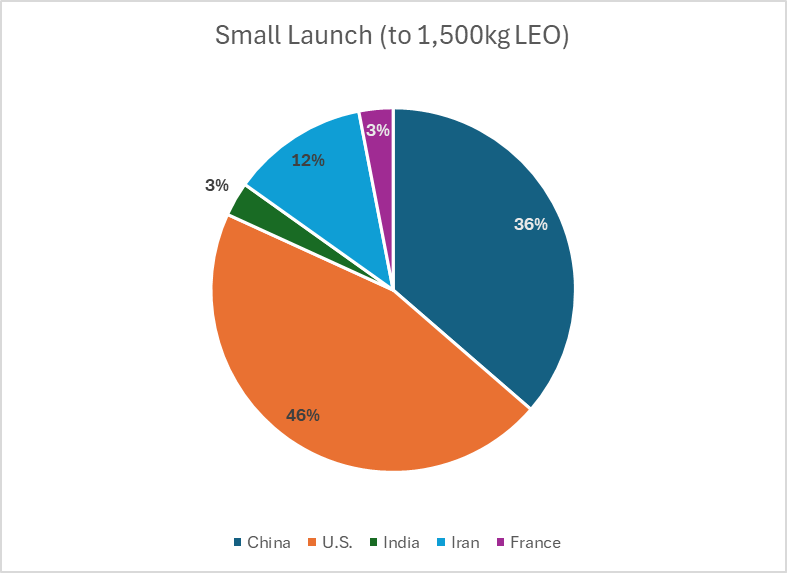

U.S. and Chinese launch providers dominated launches of small upmass-capable rockets (a combined 82% of ~33 launches). The Rocket Lab Electron accounted for nearly all U.S. small-class orbital launches conducted in 2024, whereas rockets such as the Kuaizhou, Ceres-1, and CZ-6 made up China’s small-class orbital launch share. Iran’s military launched the Simorgh and Qaem-100, while India’s SSLV and France’s Vega were each launched once.

Most small upmass-capable rockets launched in 2024 were relatively new compared to the larger mass-capable systems. The Vega might be the oldest small-class system among those launched in 2024, first launched in 2012.

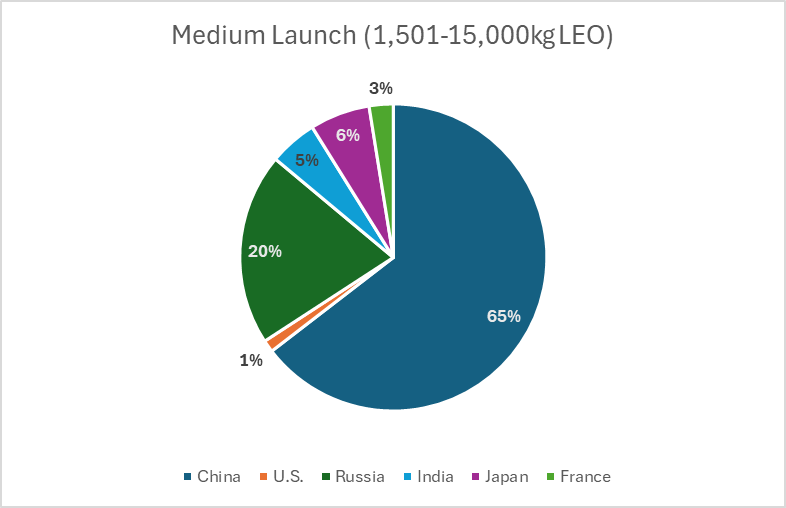

Medium-Class

About 80 launches in 2024 used 19 types of medium upmass-capable rockets. China’s launch operators conducted 65% of the world’s medium-class launches (~50). About 63% of China’s medium-class rockets are old systems (CZ-2, CZ-3, and CZ-4) in use before 2000, some since the 1980s. The newer launch systems fielded by its government-run and commercial operations will eventually replace those old ones.

The slow replacements are also why China’s rocket inventory appears so diverse. At the same time, the inventory’s scope and new medium-class rockets indicate that China’s launch providers believe there are plenty of use cases for rockets with medium upmass capability.

But the oldest rocket design used during 2024 by far is Russia’s Soyuz 2 variant, stemming from a system used in the world’s very first orbital launch. Soyuz variants were used for ~94% of Russia’s 16 medium-class launches, and there doesn’t appear to be a commitment to replace the (admittedly reasonably reliable) system.

A single Atlas V N22 launch comprised the entire U.S. share of medium-class launches. Atlas V’s can be configured into the heavy class, demonstrating the flexibility of the class. Rocket Lab will probably be the only U.S. operator in this category when its Neutron becomes operational. Stoke Space appears to be pursuing a reusable rocket with an upmass capability slightly in the class: 3,000 kg. But, like Rocket Lab, it’s yet to demonstrate a functional orbital-capable rocket in the class.

Heavy-Class

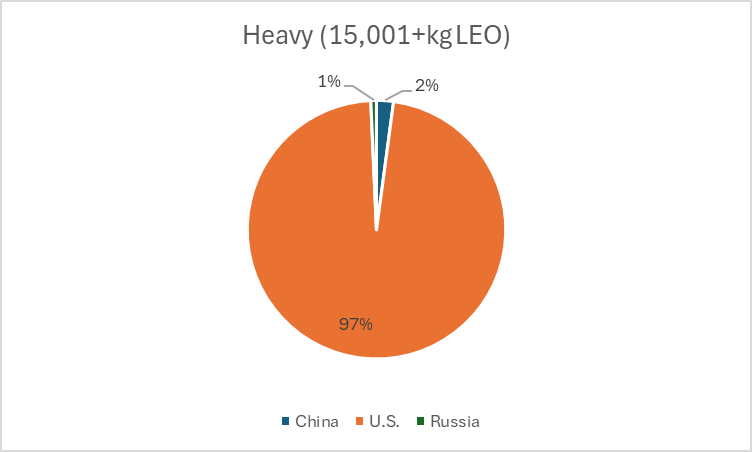

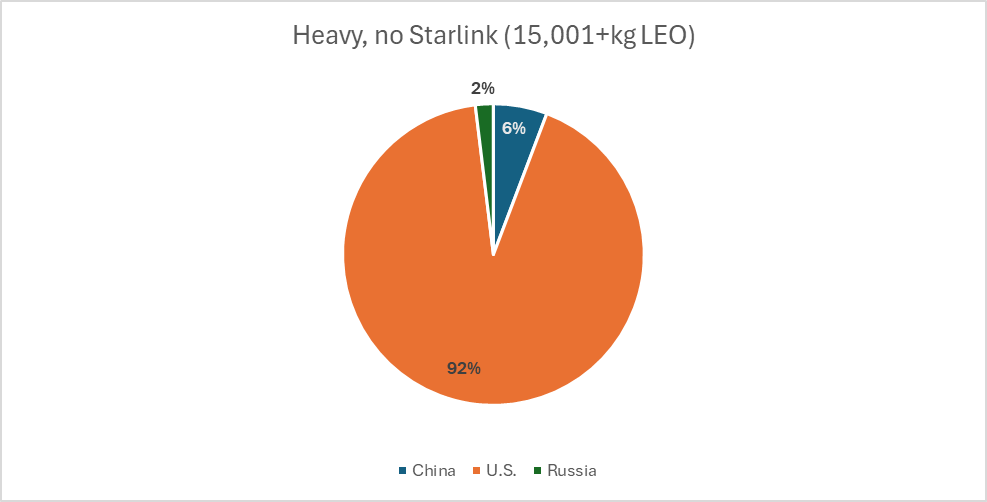

About 140 heavy-class launches were conducted, including Starlink launches. However, heavy-class launches drop to a little over 50 when Starlink launches aren't included. Whether Starlink launches are included or not, U.S. launch providers conducted the vast majority of heavy-class launches.

The Falcon 9 was the heavy-class vehicle launched most often in either graph (132 including Starlink, 42 without). However, Falcon Heavy, Vulcan, Atlas V 551, and Delta IV Heavy also took a share of U.S. heavy-class launches in 2024. Only two other nations have a single heavy launch vehicle that each used in 2024 launches: China with the CZ-5/5B and Russia’s Angara A5. The Delta IV Heavy is the oldest heavy-class rocket system of the lot that was used in 2024.

U.S. launch operators are working on more heavy-class launch vehicles, such as SpaceX with its Starship (still launching suborbitally) and Blue Origin, which just launched New Glenn in January 2025. Starship is supposed to be fully reusable. New Glenn’s first stage will be reusable (its first landing attempt failed). Operators from a few other nations point to plans for heavy-class orbital launch vehicles, but not one has conducted launch testing.

More is Better?

For 2024, then, launch operators launched rockets with an upmass capability of 1,501 kg or more 87% of the time. Not only that, some launch operators operating orbital rockets of any kind are also well into plans to build newer medium- and heavy-class rockets.

China’s launch operators have the largest inventory of medium-class rockets as well as some of the newest rockets in that category (CZ-7, CZ-12, Jielong-3, Gravity-1, etc.). China’s commercial and government launch providers are also working on a mix of medium- and heavy-class launch vehicles, such as the Lijian-2, Zhuque-3, and Long March variants. U.S. launch operators are developing new heavy-class launch vehicles, including the newly launched New Glenn.

On the other hand, small-class rocket launches aren’t nearly as frequent, which might serve as a warning to those considering entering the market. Still, some companies, particularly those in Europe and China, appear set on developing small-class rockets.

They usually don't get much further than getting a press release posted to sites such as SpaceNews.

More can be divined from the data surrounding this aspect. For a fee, I can consult with those interested in seeing and understanding those divinations.

If you liked this analysis (or any others from Ill-Defined Space), please share it. I also appreciate any donations (I like taking my family out every now and then). For the subscribers who have donated—THANK YOU from me and my family!!

Either or neither, please feel free to share this post!

Comments ()