Choosing Wisely: NRO and SDA Acquisitions

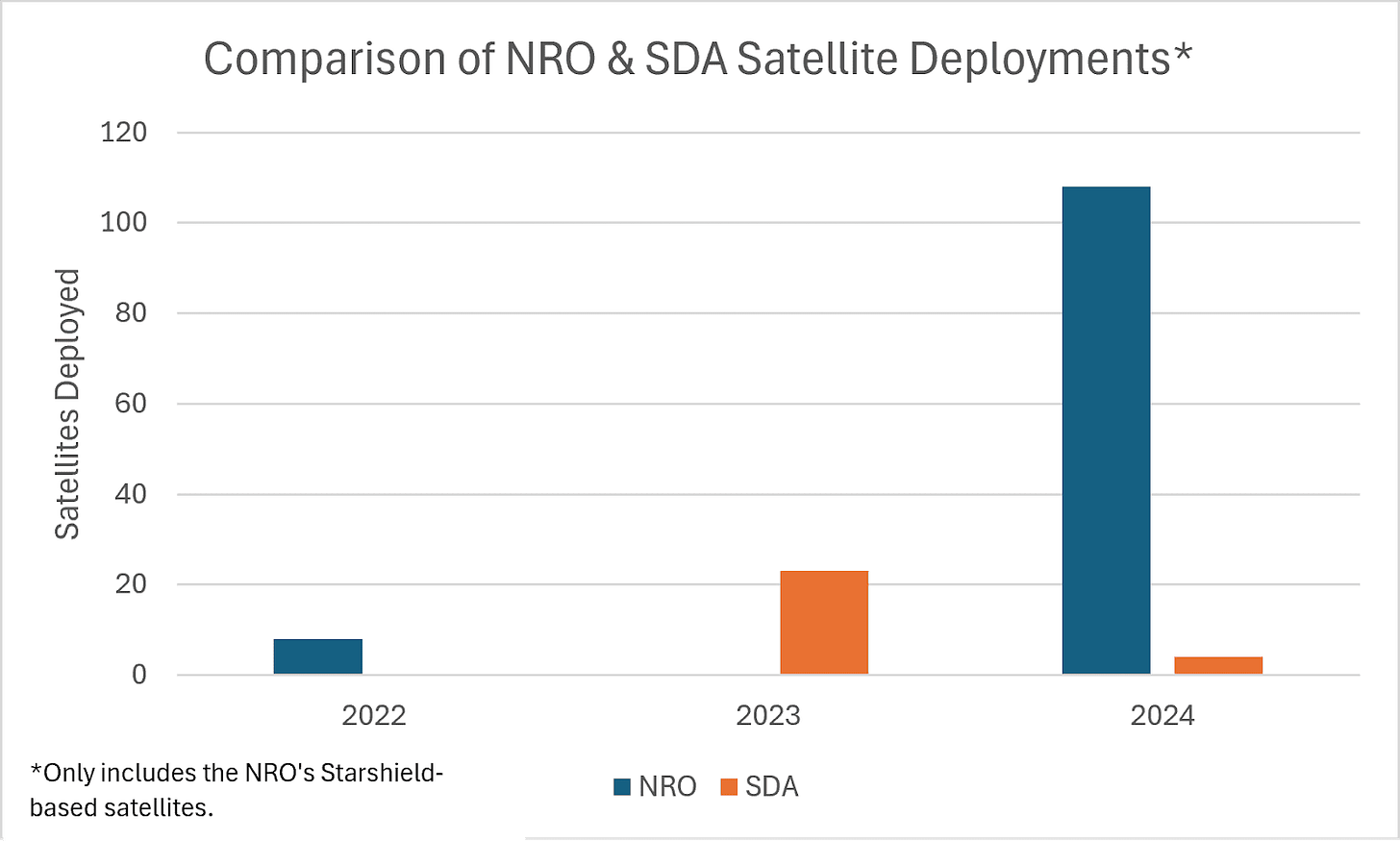

In my last analysis, I established that the National Reconnaissance Office (NRO) has fielded more satellites in the previous year than it probably ever has since its 1992 coming out (declassification)–an estimated 130 as of 10 January 25. It’s also fielding more satellites than the Space Development Agency (SDA).

Meanwhile, the SDA has deployed some satellites but is worried about supply chain challenges, particularly the encryption devices vetted by the National Security Agency. The NRO doesn’t appear as concerned about the supply chain for the Starshield-base satellites it bought.

Based on satellite numbers alone, the NRO is ahead of the SDA. But are the numbers alone the gauge for success? And does using the numbers as the success measurement potentially lead to a dark place where the U.S. Department of Defense (DoD) is (once again) beholden to a space monopoly?

Mission, Always

The mission drives everything for both agencies, from a satellite’s payload and design, its orbit, communications requirements, personnel training, outreach efforts, and more.

The NRO and SDA are buying satellites to fulfill their missions. Their missions are very different.

The NRO’s mission, mentioned previously, is broad and all about supporting U.S. national security through collecting intelligence, with a little bit of disaster relief and humanitarian aid support thrown in. Note that this mission supports many customers, from civilians in the executive branch, the other intelligence groups, the DoD, and others. Acquiring and operating new space systems, whether for signals, measurements and signatures, imagery, or other intelligence, requires plenty of funding. With such a broad customer base, there’s likely plenty of incentive to ensure the NRO gets a decent appropriation.

On the other hand, the SDA's mission is focused on the U.S. warfighter, primarily through its current plan to field satellites that can track, identify, and warn said warfighters of missiles (the earlier, the better). It mainly supports the United States Space Force (USSF) but is also a team player with other U.S. military services. That focus, however, also points to fewer customers pushing for the implementation of the Proliferated Warfighter Space Architecture (PWSA). While the system is useful, its impacts are perceived to be limited.

The NRO’s recent contract with SpaceX for the satellites it is deploying, and the SDA’s existence are both attempts to mitigate a fatal weakness in the DoD’s space acquisitions process. The time it takes for U.S. acquisition organizations to build and deploy new satellites has been a DoD Achilles Heel for a while. That delay hurts missions, including the NRO’s and SDA’s.

U.S. troops have had to wait for new space capabilities for, in some instances, decades, which, when considering the potential life-or-death consequences, is negligent. It’s so bad that U.S. military opponents could count on systems being fielded sometime in the future, with the general understanding that the future was usually decades away. But, it was how the DoD conducted space acquisitions for a long time. It is still the process for some programs and the missions they support.

A Long Game?

The NRO and SDA are adopting different methods to reduce that time and provide mission capabilities sooner. Generally, both seem successful, with the NRO currently leading in satellite deployments. Does that lead mean the NRO is more immediately addressing its mission needs? Perhaps–it depends on how well the Starshield-based satellites are functioning. Considering the NRO is continuing its series of deployments (as recently as early January 2025), they are probably functioning well enough. However, if the mission is everything, why isn’t the SDA going the same route?

At a glance, the SDA’s attempts, described in an earlier analysis, don’t appear to put its warfighter support mission above everything else and rely on companies that haven’t demonstrated they will be able to do what the SDA requires. I noted that it is attempting to accomplish a formidable task: developing and supporting a satellite manufacturing base and supply chain that had never existed prior to the SDA.

I suggest that the SDA’s efforts for mission support are longer term, as supporting its warfighters by relying on a single company for its space activities, whether for building satellites or launching them, puts that mission at risk. This is what the NRO is doing.

Sole source dependency is a very real national security issue for the DoD.

It is one that the SDA appears to recognize, especially regarding supply chain challenges, which expose previously unknown single points of failure, such as the space industry’s reliance on a single encryption hardware supplier. Given enough time, the SDA might be able to foster a satellite ecosystem with several satellite manufacturers and suppliers, giving some robustness to its satellite manufacturing base. Right now, it’s wrestling with the challenges of satellite manufacturers, but soon, it will have to tangle with ground system operators and supply (if it hasn’t started already).

The result might be that those manufacturers will provide redundant satellite manufacturing capability to support the SDA’s mission. They might even eventually leverage that capability to offer less expensive but capable satellites to commercial companies (once they can start manufacturing more than one per day). If all manufacturers survive, their competition for more profits may introduce innovations beneficial to military and commercial customers. I admit that those are unlikely scenarios unless the SDA somehow incentivizes its satellite manufacturers to chase commercial customers.

But it’s all slow going for the SDA until its manufacturers can build satellites quickly enough to support its mission. To be clear, that still appears to be faster than military satellite acquisitions even ten years ago.

Slow-walking Towards Competition?

The NRO’s approach doesn’t do this. Instead, it relies on a company with established business and satellite manufacturing capabilities. SpaceX even has partnerships, such as the one with Microsoft and its modular data centers (MDC), to provide pop-up classified broadband networks that link to satellites anywhere in the world. How the company has managed to get around the encryption hardware bottleneck is a question that might lead to answers to help the SDA’s manufacturers. The result is the NRO’s fast rollout of its latest satellite constellation.

However, there are limitations, such as only being able to launch on a Falcon 9 rocket. The Starshield-based satellites are configured on Starlink busses, and only one rocket is designed for that bus. As well, the deployments can only be done using the Falcon 9. So, the NRO depends on SpaceX for its satellites and access to space. That’s fine, so long as SpaceX continues to be reliable.

If it finally begins deploying satellites earnestly, there may be another option–Kuiper. I’ve analyzed why Kuiper might be valuable to U.S. satellite manufacturing capability. Once it establishes a manufacturing cadence, the company WILL pursue military contracts. It would be foolish not to, especially since SpaceX has already proven that there is at least one high-paying customer for satellite mass manufacturing. Kuiper and SpaceX might just be enough for redundancy while supplying proven spacecraft.

Kuiper’s entry will force some of the SDA’s companies to fold because they can’t compete. Like SpaceX, Kuiper’s primary business is itself (although it will be competing with Starlink). None of the companies the SDA is courting have that luxury. The satellite manufacturers building the SDA’s tranches will fold or be acquired since they don’t have a profitable satcom side hustle. Such shifts often occur in the technology world.

An ideal result may be that the NRO’s deal with SpaceX is a stopgap measure. It acquires capability that’s good enough and will continue to do so. By its actions, it’s buying time for the SDA to build up a robust satellite manufacturing base, whether with its current choices or a potentially more capable one (Kuiper). Either result could help with the missions they support.

If you feel generous and have the means, I appreciate any donations (I like taking my family out now and then).

Paying for subscriptions is also an option. For the subscribers who have donated—THANK YOU from me and my family!!

Either or neither, please feel free to share this post!

Comments ()