Cajole or Construct? Two Pathways to New Rockets

Two regions are facing a similar problem, the desire for more rockets. However, they are taking different approaches to fulfill that desire. One approach is hopeful, but it is generally using more of the same actions that resulted in a lack of rockets in the first place. The other approach appears to be emulation, but that “creative imitation” is a change from its earlier approaches to building rockets.

Recognizing the Consequences

The Director General of the European Space Agency (ESA), Josef Aschbacher, published an opinion piece on LinkedIn last week. Titled “A holistic approach for launchers and exploration in Europe,” he highlighted the fact of a Europe without launch capability–at least for a little while–and presented his ideas for digging out of that self-inflicted mess. His goal: “To place Europe in a leading position in terms of access to space and space exploration again…”

Of course, the first few actions he recommended weren’t surprising. He suggested actions to keep the European launch industry from backsliding more. His topmost priorities were about two rockets. He’d like to see the Vega-C rocket, which failed during launch in December 2022, operational again. He also clarified that launching the Ariane 6 would be an excellent accomplishment. He hoped both rockets would launch frequently and reliably relatively quickly.

Those are reasonable priorities and expectations from Europe’s top space leader. However, that was just his first priority. His second priority was to grow European smallsat launch capability. Unfortunately, that seems the opposite of what Europe could use now. Smallsat launchers add small satellite launch capability, but they are limited and no replacement for another launch system that Arianespace can’t launch anymore–the Soyuz (ST version). That rocket could lift ~4,850 kg to LEO from its French Guiana launch site.

However, as other launch companies have demonstrated, larger rockets can launch small payloads easily. The Ariane 62 (the initial Ariane 6 version) can lift 10,350 kg to low Earth orbit (LEO) when it eventually launches. The Ariane 6 could replace the Soyuz ST; however, the Soyuz costs much less to manufacture than the Ariane 6.

The same rule applies to smallsat launch vehicles. The Vega-C (it lifts about 2,300 kg to LEO) could be helpful in the smallsat marketplace and launch satellites that smallsat launchers are courting. But it costs more overall than a $7 million Electron (or whatever smallsat launch alternative the Europeans will eventually provide). The Vega-C’s reliability is still a question mark, too.

Addressing the Problem with the Problem

Aschbacher listed three more priorities, two of which had subsections and were wordy. He uses words such as “Prepare…for a political decision.” Or, “Prepare decisions….” Or, “...decide on a proposal…” when Aschbacher presents it two years from now.

Based on those and other words, they aren’t priorities but coordinating and planning tactics. Those tactics seemed aimed at nations and politicians to get them to consider the possibility that something might change so that Europe doesn’t find itself without a rocket again. But the words Aschbacher uses and the slow processes he’s describing indicate a continuation of the fundamental cause for Europe’s predicament in the first place–plodding politics.

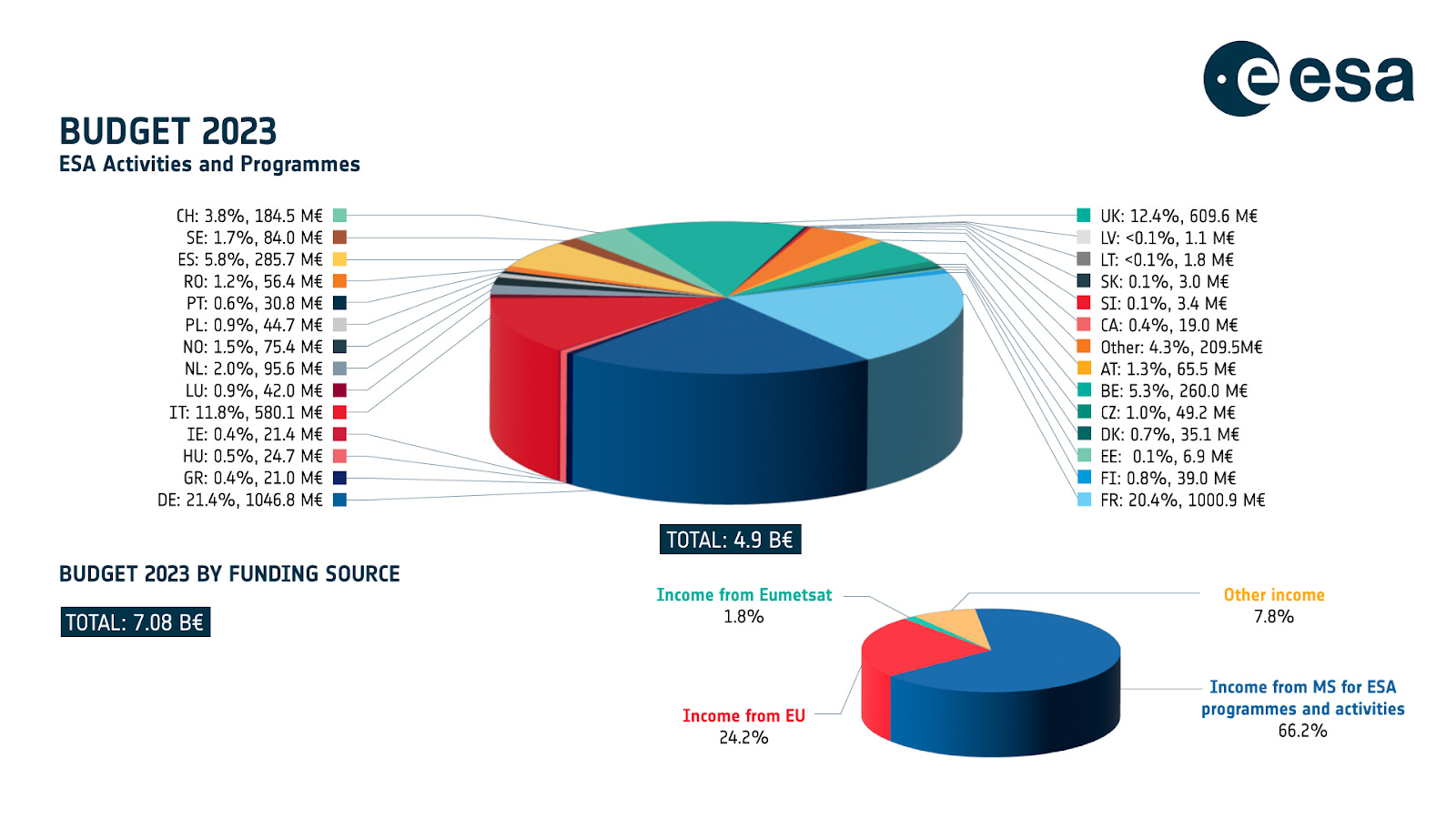

And with good reason. If Aschbacher seems reluctant to shake things up, it’s because his organization, ESA, ultimately relies on political goodwill to fund the agency (as shown in the pie chart).

France, home to Arianespace and ArianeGroup, consistently provides a large percentage of ESA’s budget (a little over 20% for 2023). Only Germany has ever provided a comparable percentage, alternating with France as the nation providing the most ESA funding during the years. The UK and Italy are the next highest contributors, with each contributing about half that of Germany. Ticking off any of the budgetary stakeholders in ESA might result in a smaller budget. The nations won’t end support of mandatory programs, but their contributions could decrease.

Or, maybe they won’t, as most ESA members generally get more out of the program than the money they put into it. For example, ESA spent over $2 billion on improving France’s Guiana Space Center. It is, after all, the only European-run gateway to space.

But none of this will help Aschbacher in his quest to get other European leaders to move quickly. Nor will it cause the changes necessary to avoid groupthink about new rocket programs and picking winners to build those new rockets. Both will combine to keep ESA from moving to the head of the space industry pack.

Others, however, are learning.

China’s CRS?

China, for example, has seen the same changes in the space industry. But, unlike Aschbacher and ESA, the China Manned Space Engineering Office (CMSEO) did more than coordinate and plan. It implemented. Whether its implementation guarantees quicker and less expensive results remains to be seen, but the office’s actions sound familiar. The CMSEO is changing how it buys its rockets. It asked commercial companies a few weeks ago for proposals for a “...low-cost transportation system to deliver cargo to and from its Tiangong space station.”

The CMSEO’s request sounds similar to NASA’s commercial cargo program, but without details about the requirements, it’s not clear that it is. And even if it is, that similarity does not guarantee the office achieves its goal. For example, it could be that companies meet the basic requirements, but their proposed solutions are too expensive, unreliable, or unworkable. On the other hand, it may be that the commercial companies in China are not mature enough to field the launch vehicles and capsules necessary to resupply the Tiangong Space Station (TSS).

However, if the CMSEO uses NASA’s commercial transportation experiments as inspiration, it probably understands that NASA’s contractual experiments could just as easily have failed. As it is, NASA’s commercial transportation initiatives have generally benefited two parties: NASA and SpaceX. Unfortunately, the other companies awarded NASA contracts to transport people or cargo to the ISS aren’t flourishing like SpaceX.

For cargo, it’s unclear that Northrop Grumman has its heart in promoting Antares for anything other than cargo transport to the International Space Station (ISS). In 2022, the company floated plans to upgrade the Antares’ engines with ones supplied by Firefly Aerospace and then indicated it might build a medium-lift launch vehicle. And Boeing’s travails while attempting to conduct at least one mission for human transportation to the ISS appears to be hurting the company more than helping it.

Also, NASA’s example is not an end-all, be-all solution for growing commercial space launch options. It went the way it did because it had no other choice. It needed transportation from U.S. soil to the ISS and didn’t want to rely on Russian launches once the space shuttle was retired.

The CMSEO may be in a similar situation. While it has access to a great range of launch vehicles, it uses only the Long March 7 (CZ-7) to get cargo to the TSS. However, unlike NASA and its dependence on the space shuttle, the CZ-7 is relatively new, launching for the first time in 2017. It’s unlikely that the CZ-7 will be retired soon. But perhaps the CMSEO sees the CZ-7 as a potential single point of failure.

However, if this approach works for the CMSEO, then there’s a chance that it could adopt it to replace the aging platform it uses for its Shenzhou crew missions, the CZ-2F. That rocket platform is over 20 years old. China’s space industry has become more active since the CZ-2F’s first launch in 1999, and probably learned a few things.

China’s and the CMSEO’s circumstances differ vastly from Europe’s and ESA’s. For one, the CMSEO appears to have a vehicle it can rely on for its launches. ESA will eventually get the Vega-C back, but it’s no substitute for a launch vehicle that can deploy larger spacecraft into orbit. And who knows when the Ariane 6 will initially launch (right now, it’s supposed to be sometime in 2024).

China’s government and space agencies also appear to have a more unified purpose and vision for space activities. As a result, they seem more willing to see the various space markets as they are and respond relatively quickly. More quickly than Europe, anyhow.

While Aschbacher knows that he must do what he can to get the European space needle moving forward, he realistically can merely cajole all European space stakeholders, actions his predecessors have also taken. Perhaps, this time, he can guide those stakeholders toward seeing the problem. Maybe he’s more persuasive than his predecessors and will get stakeholders to understand the consequences of going with business as usual (Europe’s current rocket dilemma).

Aschbacher’s activity and the required time to cajole will be contrasted with the results of the CMSEO’s acceptance of proposals from commercial launch companies. They are different approaches that perhaps highlight the cultural differences between the regions.

For the CMSEO’s approach, it’s more a matter of why it’s attempting a NASA-style approach to create a line of rockets for its TSS resupply transports. Based on China’s space industry expansion and successes, chances are pretty good the CMSEO will succeed in fostering a new line of commercial launchers for TSS. However, for Europe, it’s doubtful that Aschbacher will succeed– too much bureaucratic inertia is confronting his cause. It will likely take more disastrous consequences on European space sovereignty than a temporary lack of rockets for changes to happen.

Comments ()