2020 Commercial Global Space Market, Part 1: The Year of Government Dependence

This analysis is long enough to be a two-parter, so it is. Regular readers know my view of the global space industry is that it’s a business. The space sector comprises many smaller businesses, many of them not as “sexy” as SpaceX or Planet. My writing leans towards examining what is truly happening in the space business instead of what I’d like to see happening.

I don’t think I’ve written the following analysis in a pessimistic tone. I believe there is room for a realistic assessment of the space industry’s activities, though. Even if the analysis's conclusions and questions don’t support what others want to think and promote.

I assess that while the industry has been busy and profitable during 2020, its activities and profits aren’t signs of a healthy “commercial” space sector in the U.S. specifically. True, it's in better shape than Russia's failing sector, but there’s plenty of room for improvement.

Let’s start!

Do the Stories Hold Water?

With 2020 coming to a close, it’s not even remotely tempting to walk down the well-trod path of writing about this year’s space industry highlights or producing industry forecasts. Plenty of bloggers are already posting highlights, and I don’t wish to add the same facts to the noise.

As for the space industry end-of-year forecasts: 1) this site is about the space business and, 2) many other analysts are offering augury as a service. In many ways, those forecasts are the tabloids of the space industry--eye-catching, entertaining, and about as useful. Don't worry, though--there will be plenty of business leaders using these space industry forecasts to validate or shore up questionable business plans.

My caustic attitude toward space industry forecasts is because they are invariably optimistic and always depict some future growth. If growth doesn’t appear radical enough, some forecasts append industries that **could be** related but not entirely representative of the space industry’s activities.

An example of that type of industry would be smartphone software applications using space-based positioning, navigation, and timing signals (like GPS) for all sorts of services. While the associations and resulting services generally greatly benefit users, can a smartphone app like What3Words be considered a space industry product because it relies on GPS? What3Words is a cool idea, by the way.

Do optimism and including pseudo-related categories mean the forecasts are inaccurate? Not quite. The estimates will likely be correct because the global space industry has a steady growth history--it’s a safe bet. Note that growth forecasts stay in single-digit percentages during the periods referenced. While logical, the forecasted growth certainly isn’t miraculous--it’s just a safe bet with government backing.

That said, it is good to be aware of the realities of the stories these forecasts’ authors use to justify and promote them. The following are two examples used to justify optimistic space economy growth (and certainly not all the justifications I've observed). Sub-orbital space tourism, which still isn’t a business at 2020’s end, and annually recurring trends, such as upcoming smallsat launchers (that don’t seem to become operational), are pushed as examples of a burgeoning space launch sector. When talking about revenues, neither one of those examples will add significantly to the global space economy. Still, analysts are always bullish about their potential--but have they looked at the math?

A successful smallsat launch service provider like Rocket Lab offers its services for about $5 million per launch. The company attempted seven launches in 2020, which means customers spent at least $35 million for Rocket Lab’s services in 2020. That is less than SpaceX’s customer price for a Falcon 9 launch--around $50-62 million (depending on the source). If Rocket Lab were to launch its goal of 70 Electrons annually, customers would have paid about $350 million, possibly a more meaningful global space economy contribution in potential revenues, but not quite as much as a ULA Delta IV Heavy launch.

The same kind of math applies to space tourism, but initially on an even smaller scale. Currently, passengers can reserve a seat on Virgin Galactic’s SpaceShipTwo for $250,000 (it might be higher, soon). SpaceShipTwo will carry six passengers. A full flight of passengers would be paying a total of $1.5 million for one sub-orbital flight. Virgin Galactic plans to fly 400 flights annually, a total of $600 million from paying customers. Based on how long the company has taken not to fly any passengers for profit yet, it will take Virgin Galactic a while to get to that $600 million total. Virgin Galactic might fly operationally in 2021, but we'll see.

A Commercial Renaissance=Commercial Dominance?

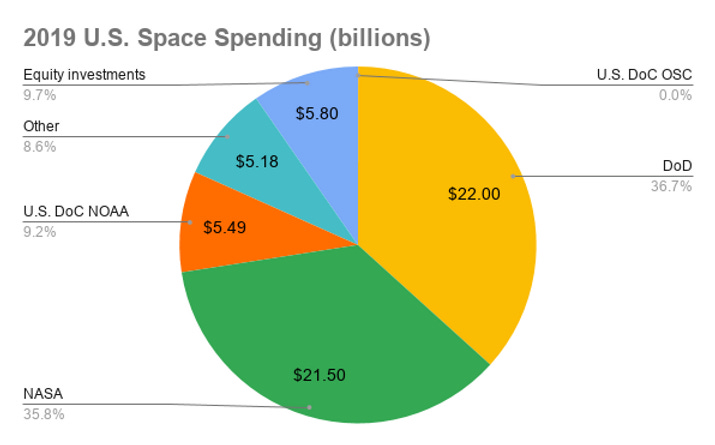

Both smallsat launch services and sub-orbital fun-rides will add to the global space economy’s bottom line, but, as the math shows, not meaningfully in the short or long term. The venture funds that help start these new space companies invested nearly $6 billion in 2019. Is that enough funding to induce commercial ventures to pursue other avenues than those offered through government contracts? Especially when 2019 government investments outspent venture capitalists nearly 10 to 1?

The 2020 space sector funding activity and results don’t make the answer to that question clear, as noted in “Commercial Space Growth--Venture Capital Driven:”

Going back to the question: can private investment help the U.S. commercial space industry overcome those challenges? The answer appears to be--maybe. For example, some of the investments Space Angels tracks include money given to SpaceX and OneWeb. SpaceX seems to be making an impact, with ambitions that include, ultimately, getting to Mars. The company’s investors are probably pleased--even as the company moves into areas that weren’t in its expertise portfolio (such as satellite manufacturing and operations), but will undoubtedly become part of it.

OneWeb’s public travails, on the other hand, seem to provide some very cautionary lessons. Before its bankruptcy, it had managed to raise a few billion dollars, but not enough to keep it from going bankrupt. Since its revival, it hasn’t moved the needle on commercial satellite operations, instead, falling back on government funding to keep it alive. But OneWeb’s vision is less ambitious, too.

Despite the low (when compared to government budgets) investments, commercial space activity in the U.S. is growing. Some of the growth is because new launch services are winning large government contracts (contributing to their competitiveness and success). And while this state of affairs isn’t quite a change from the decades of government contracting with larger aerospace companies, there is at least one new factor: a company’s DNA and vision can help change things up in the industry. Even when a company is earning much less funding from VC’s (than the money handed to the government agencies), these companies are changing the U.S. space industry.

There is growth potential away from government needs, but smallsat launch service providers and sub-orbital space tourism won’t be driving the majority of that growth. In particular, Virgin Galactic promotes an aspirational vision, hoping to eventually get enough traction to move to a point-to-point travel business (requiring a different space vehicle and much more time). Whether that vision becomes a reality depends on how quickly VG moves to safely and routinely launch tourists to sub-orbit as a business.

Both Rocket Lab and VG belong to different sub-categories of the launch market. The launch market, particularly in the United States, is still immature, as noted in “U.S. Rocket Launch Market: Strictly Commercial?” primarily because of reliance on the government. Two of three launch service providers operating large rockets in the U.S. were 100% dependent on government contracts in 2020. Certainly, U.S. launch companies appeared to keep an astonishing launch pace during a year dominated by a plague, primarily thanks to SpaceX. However, it’s laughable to think that SpaceX’s 14 Starlink launches and its Starship tests are considered critical.

It's worth noting that at least in the U.S., the space industry workforce had no choice but to work during the pandemic. This quasi-serf status is because the United States deemed the business “critical infrastructure.” This categorization allowed U.S. space companies to conduct business as usual, potentially putting employees in harmful work conditions.

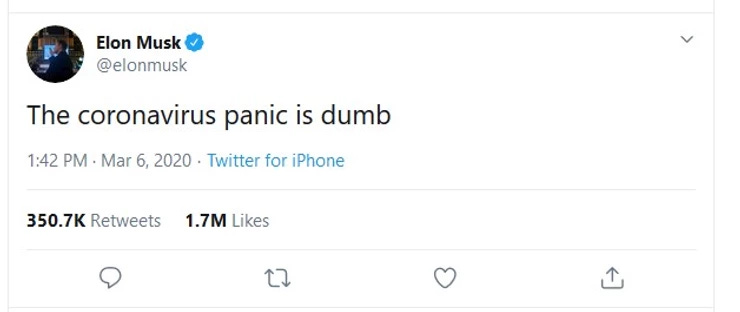

U.S. space industry workers did not have reasonable recourse, thanks to the U.S. government's categorization, as leaving a company during a pandemic would leave them effectively jobless. It will be fascinating to see the pandemic infection rates for these companies’ employees versus the rest of the U.S. workforce. Some companies attempted to accommodate employees, but SpaceX's Elon Musk displayed no empathy (and little understanding).

Despite Musk's comment and attitude, his company's non-government and government space industry activities are mesmerizing. Just as remarkable is the steadfast recalcitrance from established industry players (typically with large government contracts) around the world to consider SpaceX’s successful methods. They refuse to consider becoming as aggressive as SpaceX in schedule, costs, technology adaptation, and implementation. After all, they remain profitable without needing to do that.

This sector’s reluctance indicates that it and the larger space industry are not close to maturity even though they were making profits. As SpaceX and Rocket Lab have shown, there are different paths to becoming profitable that aren’t fully exploited. Going back to forecasts and trends--the global space industry revenues will likely have seen modest growth in 2020, mainly due to government support and bolstered by “critical infrastructure” designations.

Fortunately, there are some successful space businesses out there. More about those, the impacts of government support, and how global standards could benefit the space industry in the next post.

Comments ()