1Q21 Spacecraft Deployment Review

This is a cursory overview and analysis of spacecraft deployed into Earth’s orbit during the first quarter of 2021 (including SpaceX’s April 7th launch) and is a continuation of last week’s “1Q21 Orbital Space Launch Review.” If you wish to understand the 1Q21 activities of space launch service providers around the world, please click on that link.

I'm relying on Space-Track, Gunter's Space Page, The Space Report and my own knowledge to determine what satellites have been deployed and how many of them; what they do; and which categories they belong to.

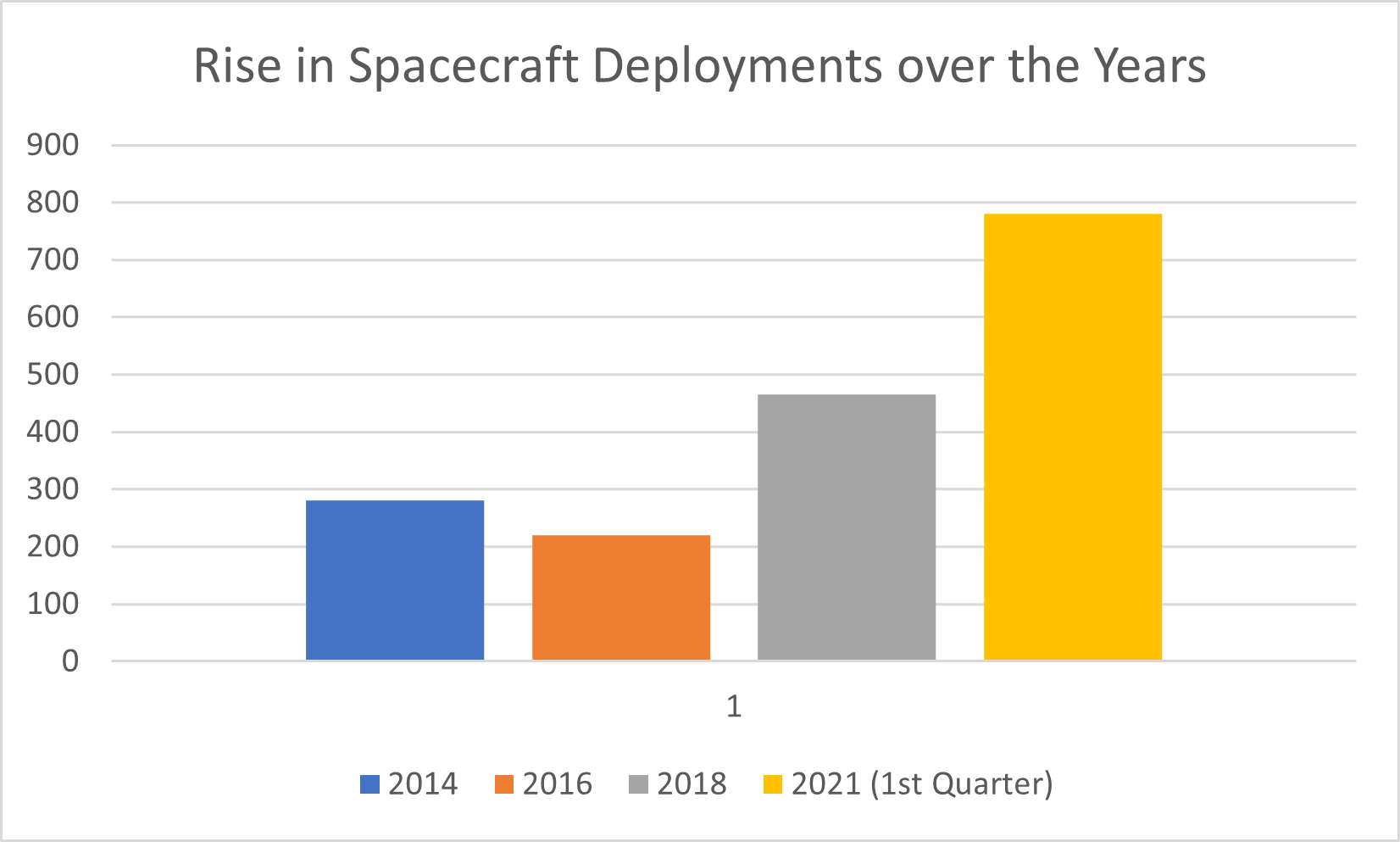

Satellite Numbers are Increasing

During 2021’s first quarter, 780 spacecraft were deployed into orbit around the Earth. That’s an astonishingly high number considering the recent “high” spacecraft deployment numbers for the whole of 2014 (~280) and the increased spacecraft deployments for 2018 (~465).

Before continuing, it’s probably good to address the elephant in the room and its impact on the spacecraft deployment data: Starlink satellite deployments. While 780 spacecraft are a lot, about two-thirds (490) of those deployments were for Starlink satellites. Those 490 Starlink satellites will continue skewing spacecraft deployment numbers higher as their deployments continue through 2021 (as they did in 2020). They will make the commercial deployments appear larger for 1Q21, too. If I can, and it’s relevant, I will provide data with and without Starlink satellites.

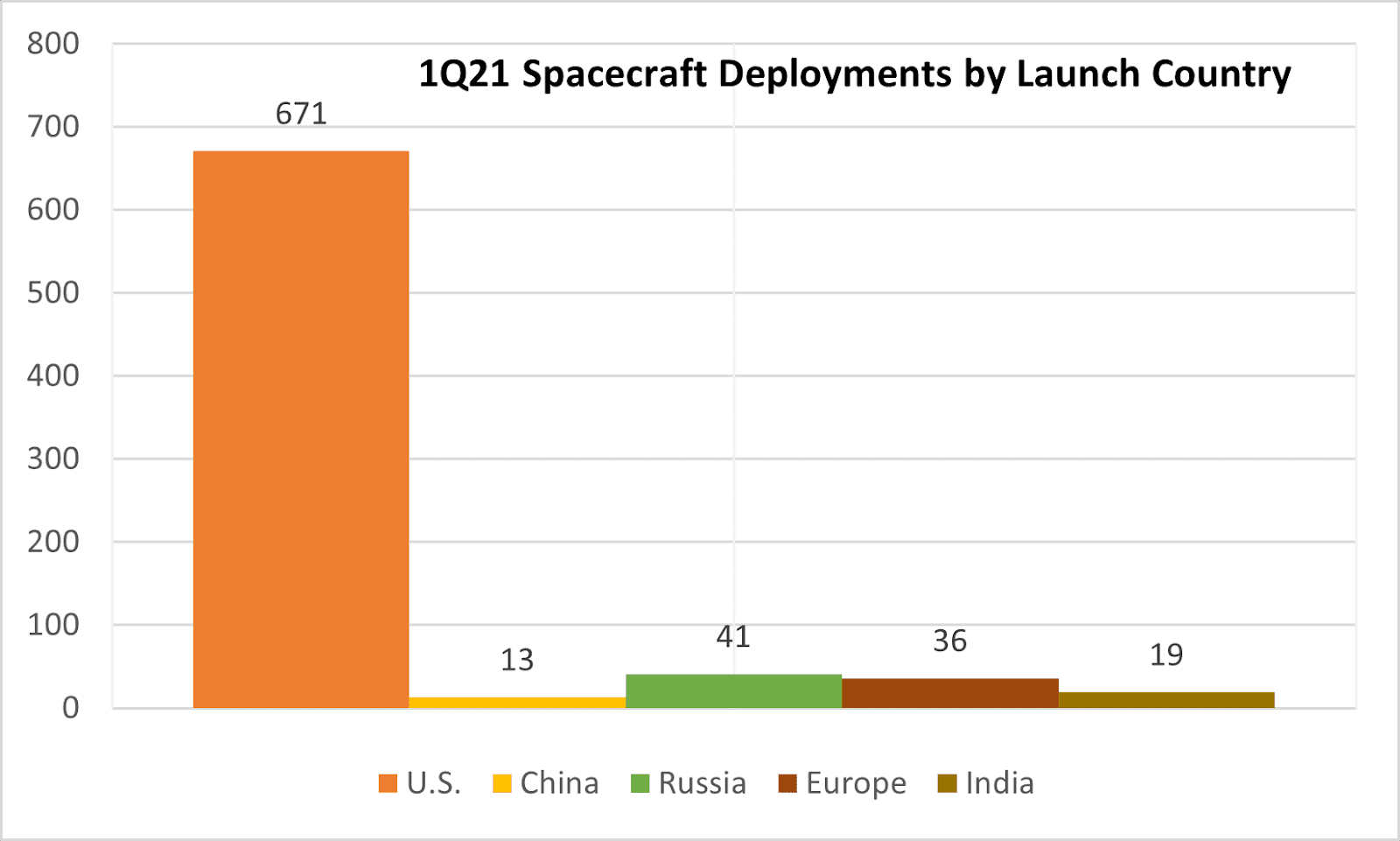

Still, of the remaining share, 290 deployed spacecraft in a single quarter is significant. Especially considering that five years ago, 280 spacecraft deployments were viewed as a high number for a year. As noted in the previous analysis, the launch service providers in four nations (and one international group) launched and deployed all 780 spacecraft in the first quarter. Unsurprisingly, primarily thanks to Starlink, U.S. launch services deployed 86% (671) of the world’s satellites during 1Q21.

Looking closely at the data, U.S. launch service providers are starting to attract more business from other nations. Northrop Grumman, Rocket Lab, and SpaceX all deployed satellites from other nations--typically using rideshare. Russian and Indian launch services also attracted foreign missions.

The standout from this trend is China: its seven launches were dedicated to Chinese missions. China’s launch services have launched a few foreign-operated satellites in past years, but not very many. For example: ~2.5% of all spacecraft deployments in China in 2018 were for foreign operators (from The Space Report 2019 Q1). Whether China’s failure to attract foreign-operated satellite missions is due to mistrust of China’s government is a pertinent question.

1Q21 Satellite Operator Breakdown

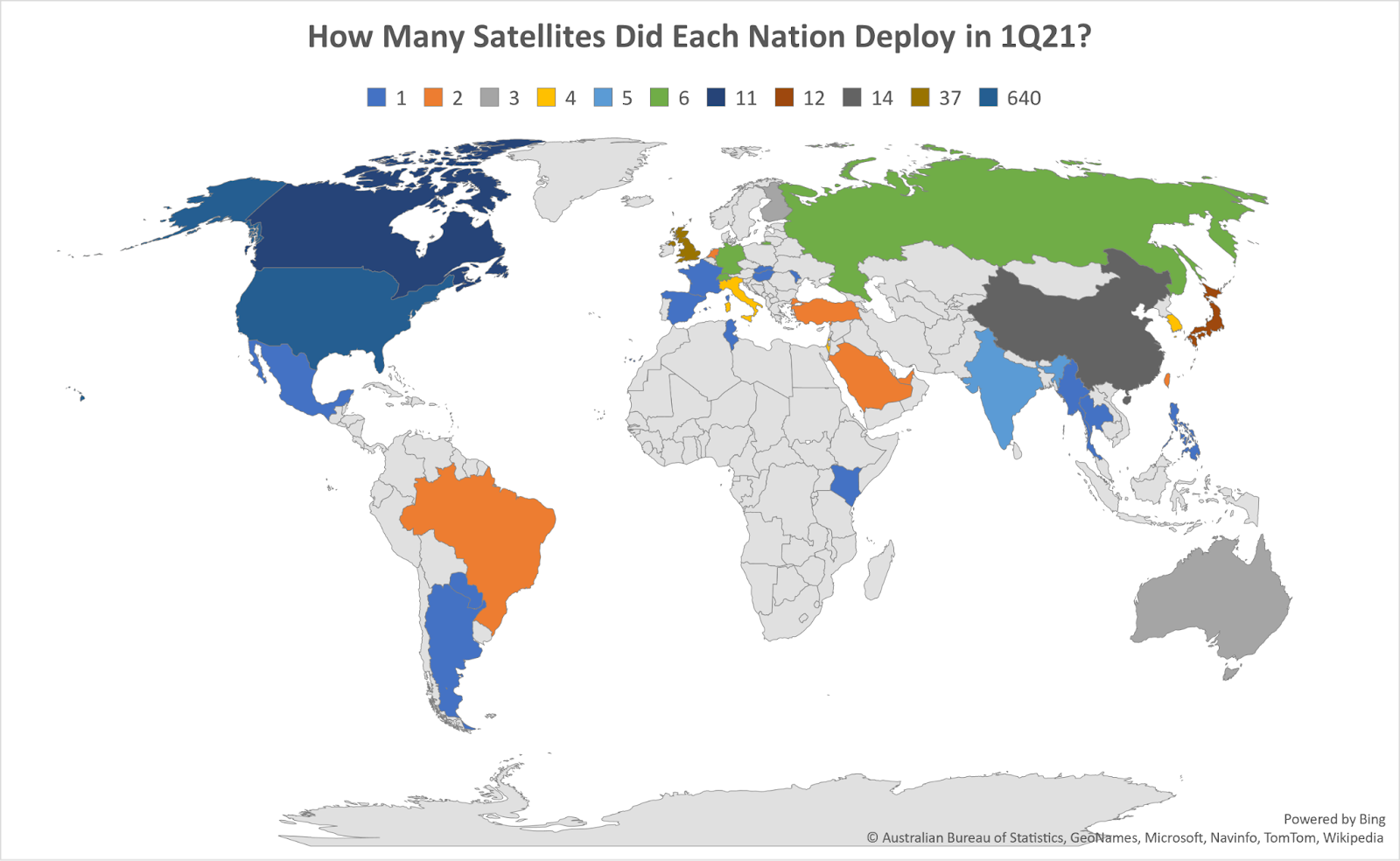

Even without Starlink, U.S. satellite operators accounted for 150 spacecraft deployments--the highest of any nation during the quarter. Include Starlink, and that number shoots up to 640 spacecraft deployed by U.S. companies. Either way, the nation with the next-highest number of deployed spacecraft during 1Q21 was the United Kingdom, with 37 (36 belonged to OneWeb).

The nations constantly highlighted in uninformed editorials for their space supremacy over the U.S.--China and Russia--fielded only 14 and six spacecraft, respectively (added together, that would be 3% of the U.S.’ 640 spacecraft). Ten of China’s 14 and one of Russia’s six spacecraft were for military missions.

In all, space operators from 33 nations deployed spacecraft into orbit during 1Q21. For a few, such as Moldova and Tunisia, 2021 was the first time those nations had deployed any satellites. About half of the 33 nations deployed small cubesats.

Surprisingly, 12 satellites belonging to Japanese operators were deployed during the first quarter even though no launches were conducted in Japan during that same time. Looking closely, at least a third of those 12 satellites were cubesats deployed for universities, implying small budgets looking for inexpensive launch opportunities (Japan’s launch services are expensive). Also playing into this is the fact that Japan’s launch service providers operate at a very **relaxed** pace, rarely launching more than seven times a year. This low annual rate may be too slow for Japanese entrepreneurs with little time, tight budgets, and antsy investors.

As noted earlier, the company deploying the most satellites was SpaceX, with 490 Starlinks deployed during 1Q21. The next highest deployments are a tie between two other U.S. companies--Planet and Swarm Technologies--with 48 satellites on-orbit each. The U.K.’s OneWeb deployed 36 satellites, coming in fourth for the number of satellites deployed during the quarter. Newer companies are beginning to deploy more satellites as well, including Astrocast and Kepler.

Switching gears to mission breakdowns.

1Q21 Satellite Mission Breakdown

As I did with the launch analysis, I am using very simplified definitions for the mission categories: civil, commercial, and military. The definitions are:

- Commercial: launches of satellites with a commercial purpose (profit is the priority)

- Civil: launches of satellites with a civil purpose (government-provided public services)

- Military: launches of satellites supporting/augmenting a government’s military

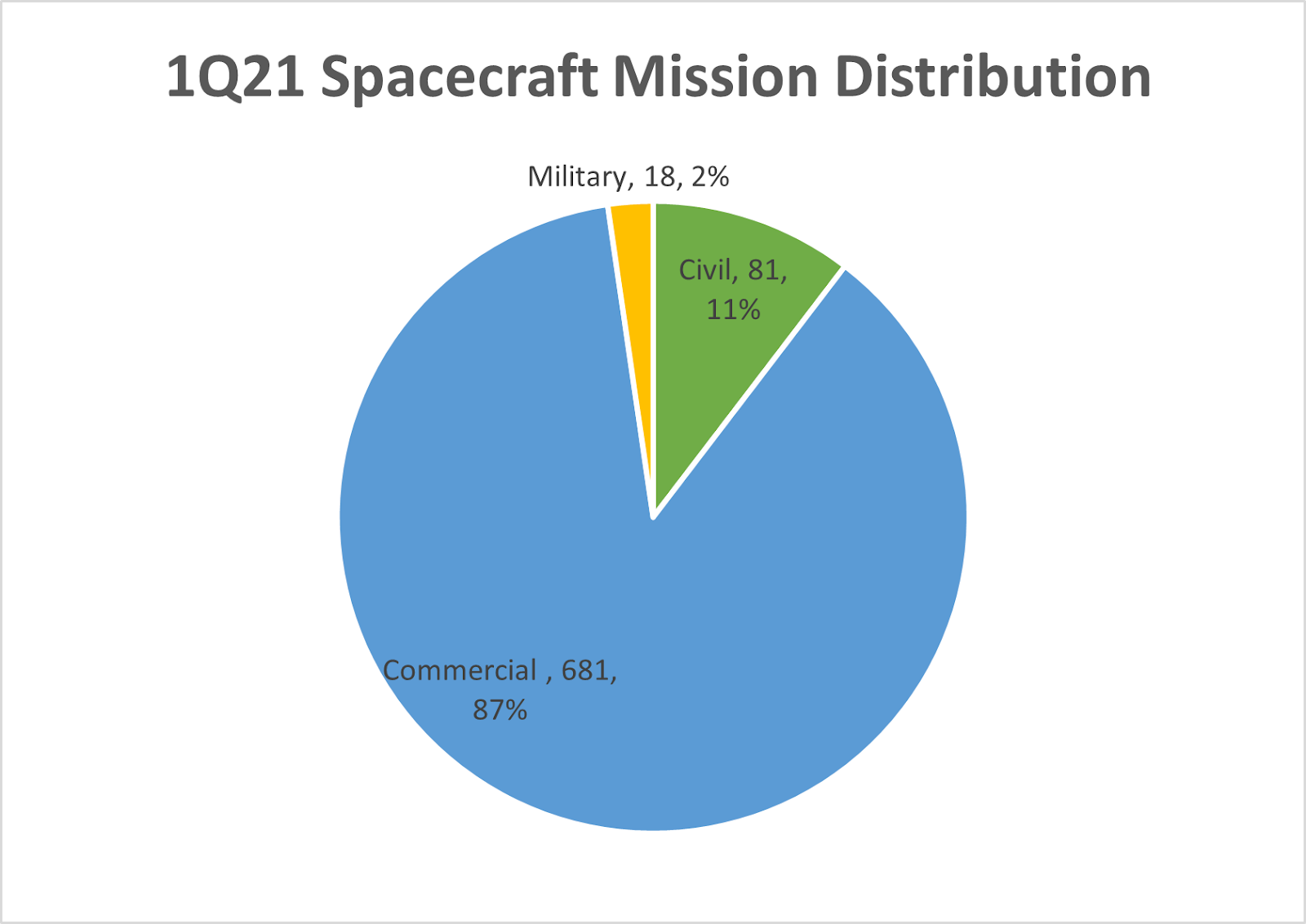

Using these categories, the share of each looks like so:

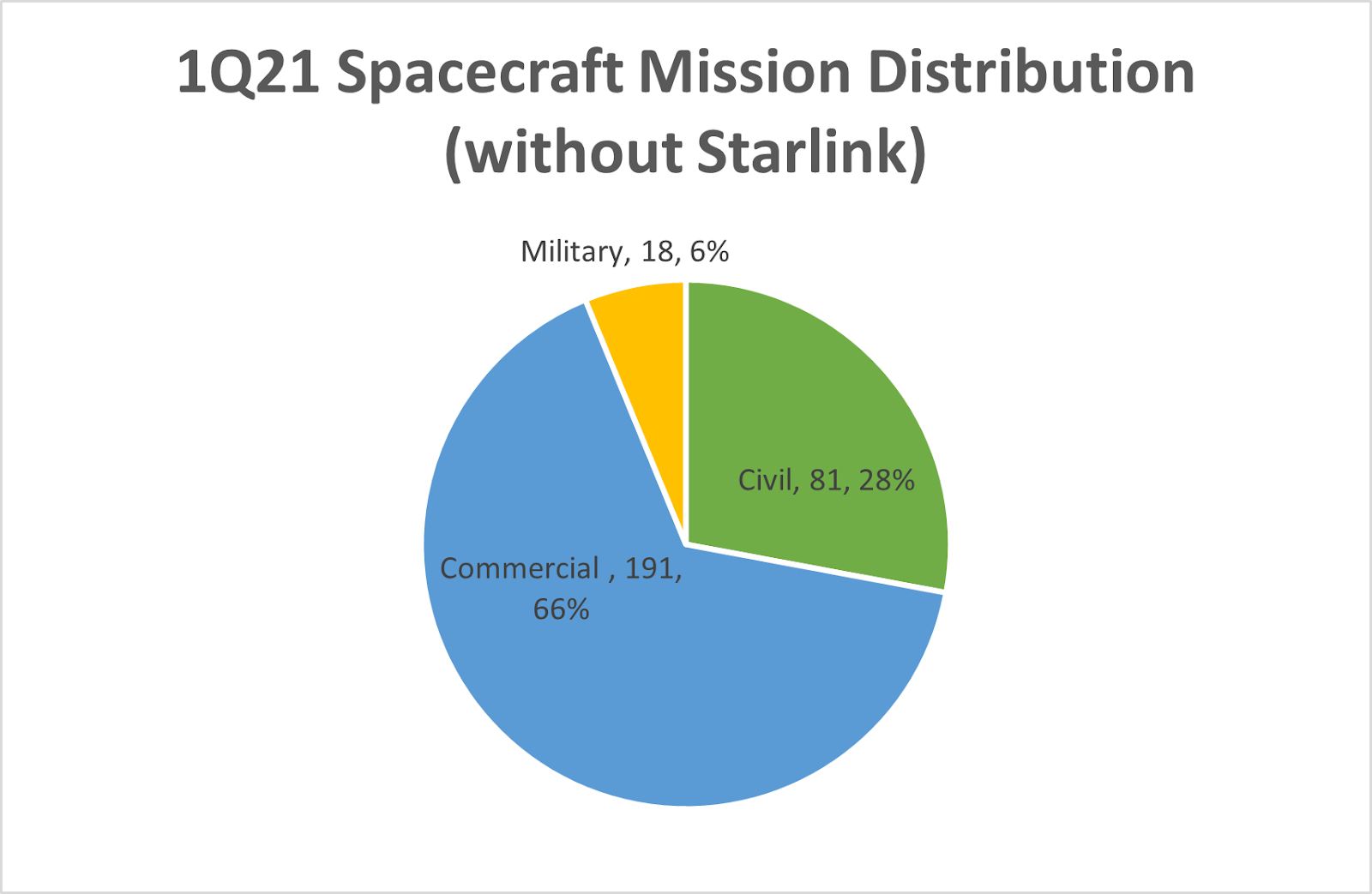

Commercial satellite deployments take a large share (87%) of all 780 deployments for the last quarter. Of course, 490 Starlink satellites are a part of those commercial satellite deployments. Does the share of commercial satellites shrink to less than civil mission shares without Starlink?

The answer is a very resounding “NO.” Commercial missions accounted for two-thirds of all satellite deployments in 1Q21. This is good news.

Consider the number of satellites deployed for commercial reasons: 191. Those aren’t the 1U cubesats deployed by universities and space agencies. Those are honest-to-goodness “working” satellites (although, to be honest, 48 of the commercial satellites are smaller than 1U--Swarm’s SpaceBEES). The majority (71) of those commercial satellites are accomplishing Earth observation/remote sensing missions. That category includes Axelspace, Planet, Spire, Capella Space, Black Sky, HawkEye360, and IcEye. Other commercial missions are less confident for a business case but more interesting--such as Astroscale’s ELSA spacecraft retrieval demonstration satellites.

Note the civil and military satellites deployed account for the remaining third of the mission distribution (without Starlink), which is where caution needs to be given. In a previous analysis, I relayed that government spending might account for 50% of global space economy estimates (at least during 2016). That share indicates that while the growth in commercial spacecraft missions (and launches) is tangible and exciting, commercial operators of those satellites may not be yet generating corresponding revenues.

Other Observations

Gleaning other helpful information from the data of this and the launch review:

Earth observation (EO) satellites are still being deployed in significant numbers. This indicates that whatever EO data is being collected currently, there aren’t enough satellites (or perhaps not enough high-resolution ones) to make the data a commodity.

Commercial signals intelligence (SIGINT) satellite deployments continued during 1Q21--as did synthetic aperture radar (SAR) satellite deployments. Before HawkEye360, there was no unclassified commercial SIGINT satellite. Considering that their predecessors were likely classified, expensive, and few, we should believe the latest deployed commercial SIGINT and SAR satellites are version 0.1 of a new commercial way to look at the world. Oil tanks are only the beginning…

Less expensive or more responsive (sometimes both) launch service providers seem to be gaining traction. It’s admittedly hard for other launch service providers to compete with SpaceX’s Rideshare price of $5,000/kg. But one way to compete is by increasing a rocket’s availability. Rocket Lab appears to be doing that, winning customers despite a significantly high price per kg ($25,000).

One last observation (for this analysis) should be made regarding SpaceX: the huge masses the company’s Falcon 9 delivers to orbit. Before SpaceX, it was rare for a company to launch a rocket close to its mass limits. Part of this is because of the design philosophy behind most satellites: even the most capable are relatively lightweight to minimize launch costs. Part of it may be because a launch company doesn’t like pushing this limit for its rockets. But SpaceX hasn’t been taking it easy on its Falcon 9 “fleet,” and it has yet to experience a launch failure with its latest Falcon 9 version despite a high annual launch rate.

Each Starlink-dedicated launch throws ~15,600 kg of mass into orbit (60 satellites X 260 kg each). Counting Starlink launches alone during the 1Q21, SpaceX has deployed ~125,000 kg of mass into orbit. That comes close to the one-third annual average of TOTAL mass estimates of spacecraft deployed from 2009 through 2019. Based on the company’s first-quarter activities and its desired launch cadence, the mass SpaceX will be deploying into orbit in 2021 will be unprecedented. It also demonstrates a few things.

First, the Falcon 9 is a well-designed workhorse. Second, it’s doubtful SpaceX could maintain its uprated launch cadence and the Falcon 9’s reliability without reusability. And finally, the company isn’t afraid to push the limits of its launch vehicle. It can push harder because the company truly understands the Falcon 9’s limits in a way non-reusable rocket manufacturers can only model. These observations and others contain a few implications regarding just how the company will use its Starship system when that comes online.

If the next three quarters are anything like the first quarter, 2021 will be the most active year for launch activities and satellite deployments so far. It’s too bad the majority of the activity will be coming from one company, SpaceX. On the other hand, even without SpaceX’s contributions, the share of commercial satellite deployments in 1Q21 was still high. If those continue, they will bring competition to SpaceX while potentially creating a more diverse marketplace.

Comments ()