Surviving the Push: Legacy Space Companies and the SDA

A recent SpaceNews article prompted me to revisit an analysis I wrote nearly two years ago. In it, I asked whether legacy satellite manufacturers, such as Northrop Grumman and Lockheed Martin, could accomplish something they rarely (if ever) do: build inexpensive satellites quickly, with no delays, for the Space Development Agency (SDA).

That agency is attempting to avoid the usual lengthy acquisition death spirals. At the time, I noted that the SDA was nudging legacy manufacturers to buy into its new space technology acquisitions model. At the time, the question I posed was: Could the legacy manufacturers adapt to the SDA’s needs?

I thought they might, but it was not a confidence-inspired belief. While both companies offer in-house satellite buses, sensors, etc., neither could build satellites quickly (for reasons listed in the analysis). I assumed their inability was why both companies turned to smallsat manufacturers such as Terran Orbital and Airbus OneWeb to help meet the SDA’s requirements. This seemed to work for them, as Lockheed deployed 10 SDA satellites in 2023, and Northrop is on track to deploy its Airbus-based satellites for SDA in September 2024.

Since that article, the SDA has begun pushing instead of nudging. Not all legacy companies appear to be dealing well with these shifts in military space acquisitions.

L3Harris, yet another military-focused aggrecorporation, appears to be one of those. The SpaceNews article portrayed it as a company under stress. L3Harris publicly blamed both space industry supply chain and Moog for its inability to meet the SDA’s schedule (despite having over three years to build four small satellites). Why the company felt compelled to publicly point fingers at Moog is a good question.

Like Northrop and Lockheed, L3Harris chased the SDA contracts, knowing the new and aggressive requirements. And, like Northrop and Lockheed, the company had no in-house capability to produce satellites in the quantity the SDA needed in the time it needed them. That deficiency is why L3Harris subcontracted with Moog to build its satellites (with Maxar for the next set). It was (and is) attempting to adapt to SDA’s needs through subcontracting.

Why Moog?

It’s puzzling that L3Harris chose Moog, considering the company hadn’t demonstrated an ability to quickly manufacture a single satellite bus (Meteorite), much less four within three years. L3Harris blamed Moog for a year-long satellite delivery delay, causing it to miss its initial SDA satellite deployment schedule. L3Harris’ challenges with Moog might have driven its later decision to use Maxar for SDA work.

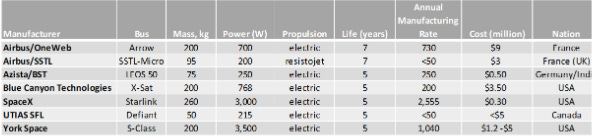

While Moog is known for space components, etc. (but not music synthesizers–that’s a different Moog), it isn’t known for the fast mass production of satellites. In contrast, companies such as SpaceX, Airbus OneWeb, York Space, and Blue Canyon Technologies/Raytheon have advertised the ability to deliver tens, if not hundreds, of spacecraft annually. At least they advertised their ability to do that during 2021 when I made the chart below.

Yes, other smallsat manufacturers also exist, but I’m repurposing this chart merely to make a point: Moog was not competitive in this class. Again, the chart data came from ~2021, around the time L3Harris selected Moog for its SDA contract. Moog does offer a satellite bus with comparable characteristics: Meteorite.

I didn’t seriously consider Moog as a company that could pump out satellites at even modest rates and certainly not at a competitive cost (an estimated $19 million per bus to L3Harris). Based on its press releases, the company won’t join the listed ranks anytime soon. In late 2022, Moog opened a satellite manufacturing facility in Colorado. At the time, one of its managers noted:

“Our avionics solutions are proven in geostationary and low Earth orbit,” Athoe said. “Our niche is providing dozens of high reliability space vehicles that can meet the government’s need for responsive missions that have to work.”

That rationale is similar to ULA’s reasons for focusing on government launches. As with ULA, it’s also profoundly head-in-the-sand business planning. “Dozens” without a given time frame, such as a week or year, is a noncompetitive and meaningless quantifier. If Moog plans to build merely dozens over the facility's lifetime, that’s also not an excellent investment. Moog is going through the motions but not even bothering to compete with the likes of York Space. That low-volume satellite bus manufacturing capability might be another reason for L3Harris’ decision to use Maxar in the next tranche.

It’s not clear why L3Harris chose Moog. Especially when comparing the company’s satellite manufacturing with SpaceX’s accomplishments with its Starlink buses.

Satellite Mass Manufacturing in the U.S.

Since the first 60 Starlink satellites were flung into orbit five years ago (May 2019), the company has manufactured and deployed over 6,200 satellites. The Starlink bus has undergone about six iterations during its massive rollout, not including the TinTin prototypes. Has the company achieved the estimated annual satellite manufacturing rate of 2,555 it advertised in 2021? Since SpaceX is close-mouthed about actual production rates, the numbers used in the remainder of this analysis are from its spacecraft deployments. They point to the answer “no.” Also, why would the company manufacture double the satellites it can deploy annually?

SpaceX deployed ~1,250 Starlink satellites annually during those five years. That’s a little over three satellites manufactured per day per year. However, the company deployed “only” 120 Starlinks in 2019. It started ramping up launches in 2020 despite the pandemic raging worldwide. Referencing four instead of five years, the company averaged launching a little over 1,500 Starlinks annually. That number doesn’t consider the SDA satellites that SpaceX deployed using Starlink buses.

Airbus OneWeb has also demonstrated the ability to manufacture at least hundreds of spacecraft a year (which is why Northrop turned to the company for its SDA satellites). The company deployed nearly 640 spacecraft from February 2019 through May 2023–about 160 annually. To be fair to OneWeb, it went through bankruptcy during that period, the pandemic, AND then the loss of Russian-made Soyuz rockets to deploy its satellites. It’s likely the company manufactured more than 160 satellites annually.

These two companies, OneWeb Airbus and SpaceX, have demonstrated an ability to produce more satellites in a single year than Lockheed Martin, Northrop Grumman, L3Harris, etc., have during decades of satellite manufacturing. Even the specialty smallsat manufacturers the legacy manufacturers are turning to have yet to demonstrate a similar manufacturing capacity. Of course, they don’t have a reason for building so many spacecraft that drive OneWeb or SpaceX–low Earth orbiting internet relay constellations. The SDA isn’t asking for the ludicrous satellite numbers that OneWeb or SpaceX have announced.

As expected, both companies have branched out and are offering their buses to other customers, some of them government agencies that Moog is aiming for. How does it make sense for Moog to only compete in the market that SpaceX and OneWeb don’t rely on but aggressively pursue because of the higher margins? Especially when L3Harris publicly notes Moog’s difficulty in building reliable spacecraft for it and the SDA.

Lockheed Martin and Northrop Grumman don’t appear to have experienced similar problems with their smallsat subcontractors—or, at least, there are no publicly aired problems. If anything, Lockheed Martin’s recent bid to buy Terran Orbital validates Terran Orbital’s utility in the market. Terran Orbital will use the top cover and resources from Lockheed Martin because yet another U.S. satellite manufacturing giant will enter the market soon: Amazon Kuiper. At least it might have, except Lockheed just withdrew its bid.

A Rising Tide Overwhelms Existing Businesses

Once it establishes an initial viable constellation network, one only has to look at OneWeb’s and SpaceX’s activities to understand Amazon's next step. The company has yet to provide marketing numbers regarding the factory output of its satellites, but they will likely approach SpaceX’s Starlink output and significantly exceed OneWeb Airbus’. That’s a considerable amount of combined manufacturing capacity. When Amazon is done building satellites for its business, its capacity will undoubtedly be used to build satellites for other customers.

In my older analysis, I asked whether the legacy manufacturers could meet the SDA’s needs. It looks like almost all can…with help. But maybe that was the wrong question to ask. Instead, the question is: Do the legacy satellite manufacturers matter when others can produce hundreds of satellites in a year without pause?

Think of the hundreds and thousands of spacecraft that two companies already produce and the hundreds to thousands more that Kuiper will likely bring to the market. Then, look at the years it took for the legacy companies to complete just one spacecraft (regardless of the customer). Look at Moog’s struggles, which impacted L3Harris. The stated cause, supply chain issues, seems questionable. They didn’t seem to impact OneWeb, Starlink, or Terran Orbital production overly much.

How can these old companies compete when their organizations, processes, and technology aren’t designed that way? If they can’t fulfill obligations to the SDA, then the SDA has several other competitors to choose from that have demonstrated that they will, usually for less. Legacy businesses must change, or they will lose to the more hungry satellite manufacturers. It doesn’t mean they can’t manufacture satellite components, however–unless they can’t keep up there, either.

No wonder the SDA’s director has little sympathy for the legacy manufacturers. The challenges that delayed L3Harris’ satellites confirm their inability to change and compete. The SDA’s nudge has some companies teetering on a ledge. Together, Moog and L3Harris struggled to produce and launch just four satellites 3.5 years after the contract award. Those delays lean more towards legacy philosophy than a willingness to change to the SDA’s needs. A push might make their satellite-manufacturing efforts irrelevant.

Strangely, though, the SDA recently awarded L3Harris a larger contract (nearly $1 billion) for more satellites. Even though the SDA’s insistent pushing is causing some companies heartache in adapting, the SDA rewarded a company’s inability to meet schedule with a larger contract. That seems to be a very familiar DoD business practice that the SDA was supposed to distance itself from, especially considering that there are other, more capable companies already providing for the SDA’s needs.

Maybe the push is more of a fake?

If you liked this article (or any others from Ill-Defined Space), any donations are appreciated. For the subscribers who have donated—THANK YOU!!

Comments ()